It’s no big secret that we’re a fan of Singapore REITs in general. The good REITs own a portfolio of properties that generate steady rental income and pay a growing tax-free dividend. Besides that, you also get to enjoy some upside in capital appreciation.

While the pandemic has affected retail and commercial REITs more so than others, the well-managed REITs that own high-quality properties in good locations will continue to do well in a post-pandemic world.

In Singapore, the two largest retail-commercial REITs are CapitaLand Integrated Commercial Trust (CICT) and Mapletree Commercial Trust (MCT). Both own a portfolio of high-quality shopping malls and office buildings in Singapore (CICT also has a small portfolio in Germany), and have a track record of paying a stable dividend. But if you had to pick one, which should you go for?

In this article, we’ll compare some of the key qualitative and quantitative metrics between CICT and MCT… and decide.

1. Property portfolio

CICT is currently the largest REIT listed in Singapore with a market cap of S$13.6 billion as of June 2021. CICT’s Singapore portfolio of retail properties include popular malls like Plaza Singapura, Bugis Junction, and Tampines Mall. In October 2020, CICT completed its merger with CapitaLand Commercial Trust (CCT) absorbing its portfolio of offices and integrated developments including CapitaGreen, Capital Tower, and Asia Square Tower 2. In total, CICT now owns 22 properties in Singapore and two office buildings in Frankfurt, Germany.

MCT is the fifth largest REIT in Singapore with a market cap of S$7.1 billion as of June 2021. It owns five properties in Singapore: VivoCity, Singapore’s largest mall; Mapletree Business City, an integrated office and business park; and three office buildings, mTower (formerly PSA Building), Mapletree Anson, and Bank of America Merrill Lynch HarbourFront.

Over the last five years, both CICT and MCT have steadily grown their net asset value (NAV) per unit, except for 2020 due to the pandemic.

| CICT | FY16 | FY17 | FY18 | FY19 | FY20 |

| NAV per Unit (S$) | 1.86 | 1.92 | 2.00 | 2.07 | 2.00 |

| MCT | FY16/17 | FY17/18 | FY18/19 | FY19/20 | FY20/21 |

| NAV per Unit (S$) | 1.38 | 1.49 | 1.60 | 1.75 | 1.72 |

Note: CICT and MCT’s financial year ends 31 December and 31 March respectively. For comparison, CICT’s five-year period in the table above is from January 2016 to December 2020 and MCT’s is from April 2017 to March 2021.

This means both REITs have been able to steadily grow the value of their portfolios over the years without taking on too much debt.

2. Occupancy rate

For a landlord like a REIT, it’s important to have your properties be as fully occupied as possible. A high occupancy rate means that a property is well-located, and its space is in high demand among tenants. On the other hand, a low occupancy rate could mean that a property is poorly managed or in an undesirable location.

Over the last five years, CICT and MCT’s occupancy rates have remained extremely healthy at 95% to 99%.

| CICT | FY16 | FY17 | FY18 | FY19 | FY20 |

| Occupancy Rate (%) | 99 | 99 | 99 | 99 | 96 |

| MCT | FY16/17 | FY17/18 | FY18/19 | FY19/20 | FY20/21 |

| Occupancy Rate (%) | 98 | 95 | 98 | 98 | 97 |

The high demand also means that both CICT and MCT are able to command higher rents because even if a tenant were to leave, another is ready to take its place. At the same time, it’s important to know if a REIT has a large tenant that has its lease expiring soon and is not expected to renew. While a space vacated by a smaller tenant is easy to fill, replacing a large tenant is much harder.

CICT’s largest tenant is RC Hotels which contributes 5.7% of gross rental income. As the hotel operator of Swissôtel The Stamford and Fairmont Singapore, RC Hotels is on a long-term master lease until December 2036.

MCT’s largest tenant is Google Asia Pacific which contributes 10.7% of gross rental income. Google is housed at Mapletree Business City II which has a weighted average lease expiry of 2.7 years as part of MCT’s office/business park portfolio. Singapore serves as Google’s Asia-Pacific headquarters and the tech giant has not given any indication that it would not continue its lease at Mapletree Business City II.

3. Net property income

Net property income (NPI) is a property’s gross revenue minus its operating expenses. A successful REIT will show a consistent track record of growing its total NPI over time. Over the last five years, CICT and MCT have steadily grown their NPI except for 2020.

| CICT | FY16 | FY17 | FY18 | FY19 | FY20 |

| NPI (S$ million) | 479.7 | 478.2 | 493.5 | 558.2 | 512.7 |

| MCT | FY16/17 | FY17/18 | FY18/19 | FY19/20 | FY20/21 |

| NPI (S$ million) | 292.3 | 338.3 | 347.6 | 377.9 | 377.0 |

MCT recorded a small 0.8% dip in NPI in FY20/21 due to a maiden full-year contribution from the recently acquired MBC II which helped to cushion the impact of the pandemic.

CICT’s NPI fell 8.1% in FY20 as the REIT provided rental reliefs and financial support for qualifying tenants affected by the pandemic. However, we should see financial results improve for CICT as it similarly records a maiden full-year contribution from the acquisition of CCT properties in its upcoming financial year.

Comparing the growth rates of both REITs pre-pandemic (from FY16/17 to FY19/20), MCT has grown its NPI by 29.3%, while CICT has grown its NPI by 16.4% over the same period.

4. Gearing

A REIT is a leveraged investment instrument and will typically take on a certain amount of debt to boost its returns. The amount of debt is presented in its gearing ratio which compares the REIT’s total debt to its total assets. While debt can boost returns, too much debt is inherently risky. In Singapore, REITs have a gearing limit of 50% set by the MAS.

Over the last five years, CICT and MCT have maintained their gearing ratios at the mid-thirties range.

| CICT | FY16 | FY17 | FY18 | FY19 | FY20 |

| Gearing Ratio (%) | 34.8 | 34.2 | 34.2 | 32.9 | 40.6 |

| MCT | FY16/17 | FY17/18 | FY18/19 | FY19/20 | FY20/21 |

| Gearing Ratio (%) | 36.3 | 34.5 | 33.1 | 33.3 | 33.9 |

CICT’s gearing ratio increased in FY20 due to higher borrowings as a result of the merger with CCT. CICT’s management has said that the higher gearing is still manageable in the short term, and they will remain disciplined in managing the REIT’s gearing profile.

5. Sponsor

A sponsor is typically a parent company that injects properties into a REIT’s initial portfolio when it lists. A strong sponsor can provide stable financial backing and a pipeline of new, valuable properties for the REIT in the future.

CICT is backed by CapitaLand, one of Asia’s largest real estate groups with S$137.7 billion in assets under management (as at 31 March 2021). Similarly, MCT is backed by Mapletree Investments, another leading real estate player with S$66.3 billion in assets under management. CapitaLand and Mapletree are, in turn, backed by Temasek Holdings.

This is as strong as you can get.

6. Distribution per unit

At the end of the day, income investors are looking for dividends when they invest in a REIT. A successful REIT should have a track record of paying a steady – and growing – distribution per unit (DPU).

Over the last five years, CICT and MCT have steadily grown their DPU except for the financial years impacted by the pandemic.

| CICT | FY16 | FY17 | FY18 | FY19 | FY20 |

| DPU (S$) | 11.13 | 11.16 | 11.50 | 11.97 | 8.69 |

| MCT | FY16/17 | FY17/18 | FY18/19 | FY19/20 | FY20/21 |

| DPU (S$) | 8.62 | 9.04 | 9.14 | 8.00 | 9.49 |

Removing the financial years impacted by COVID-19, CICT’s DPU grew 7.5% from FY16 to FY19, and MCT’s DPU grew 10.1% from FY16/17 to FY 20/21.

7. Distribution yield

Dividends are great but knowing your potential yield before you purchase a stock is just as important. If you invest in a stock for dividends, its yield should be higher than the risk-free rate. If not, you’re better off investing in the risk-free asset. In Singapore, the risk-free rate is the 4% interest you receive from your CPF Special Account (with the caveat that you can only withdraw a proportion of your CPF funds at age 55).

The table below shows the distribution yield of CICT and MCT based on their annual DPU and unit price at the end of each financial year.

| CICT | FY16 | FY17 | FY18 | FY19 | FY20 |

| Distribution Yield (%) | 5.6 | 5.3 | 5.0 | 4.9 | 3.8 |

| MCT | FY16/17 | FY17/18 | FY18/19 | FY19/20 | FY20/21 |

| Distribution Yield (%) | 5.6 | 5.8 | 4.9 | 5.3 | 4.5 |

As you can see, both REITs have fetched very decent yields over the last five years and easily beat the 4% interest from your CPF SA. CICT’s FY20 yield is depressed due to a large drop in DPU.

In the short term, the Singapore government has announced that landlords will have to extend rental reliefs once again which may impact DPU slightly, but I expect distributions to improve as the pandemic eases, restrictions are lifted for vaccinated individuals, and the overall economy improves.

The fifth perspective

Both CICT and MCT are solid investments and can be considered ‘best-in-class’ among Singapore REITs. If I had to pick only one, I would lean toward MCT which has shown a slightly better management track record of growing its NPI and DPU.

However, this article only touches the surface of both REITs; there are other key factors and metrics to consider when doing your research and it’s important to always do your due diligence before you invest.

If you’re looking to invest in Singapore REITs and don’t like the hassle of picking individual REITs on your own, you can consider a diversified REIT portfolio like Syfe REIT+ which tracks the iEdge S-REIT Leaders index.

Launched in partnership with the SGX, the Syfe REIT+ portfolio holds CICT and MCT amongst its top holdings. It comprises Singapore’s top 20 REITs across not just the retail and commercial sectors, but also industrial, hospitality and healthcare. The portfolio’s overall dividend yield was 4.5% in 2020. In 2021, Syfe estimates dividend yield to increase to 5.1%.

Apart from CICT and MCT, Syfe REIT+ also provides exposure to other retail and commercial REITs like Frasers Centrepoint Trust and Keppel REIT so you can get access to the best of Singapore’s retail and office properties. Syfe doesn’t charge any brokerage fees and investors can start with as little or as much as they want as there is no minimum investment sum.

If you’re keen to invest in the overall Singapore REIT market, Syfe is offering The Fifth Person readers 6 months of free investing! Use the code FIFTHPERSON to get your first $30,000 deposit managed free for 6 months. There are no lock-in periods and you can withdraw anytime. Find out more about Syfe REIT+ here.

This article is written in collaboration with Syfe.

Good summary. MCT has done really well since listing (my Mrs has held their shares for a while). My only concern is the large office component within its portfolio. CICT also a very good company. However, I have doubts about the future of retail property due to the rise of eCommerce. I don’t completely buy the argument that Singapore is all that different from other countries when it comes to shopping habits.

Thanks for sharing your thoughts, Jonathan! I think COVID has hit the brakes a little for the office and retail sectors with WFM and e-commerce respectively. Malls, especially, will have to evolve beyond just hawking goods that anyone can shop for online. At the same time, I think well-located offices and malls will still remain relevant in Singapore over the long run due to our limited land.

Hello,

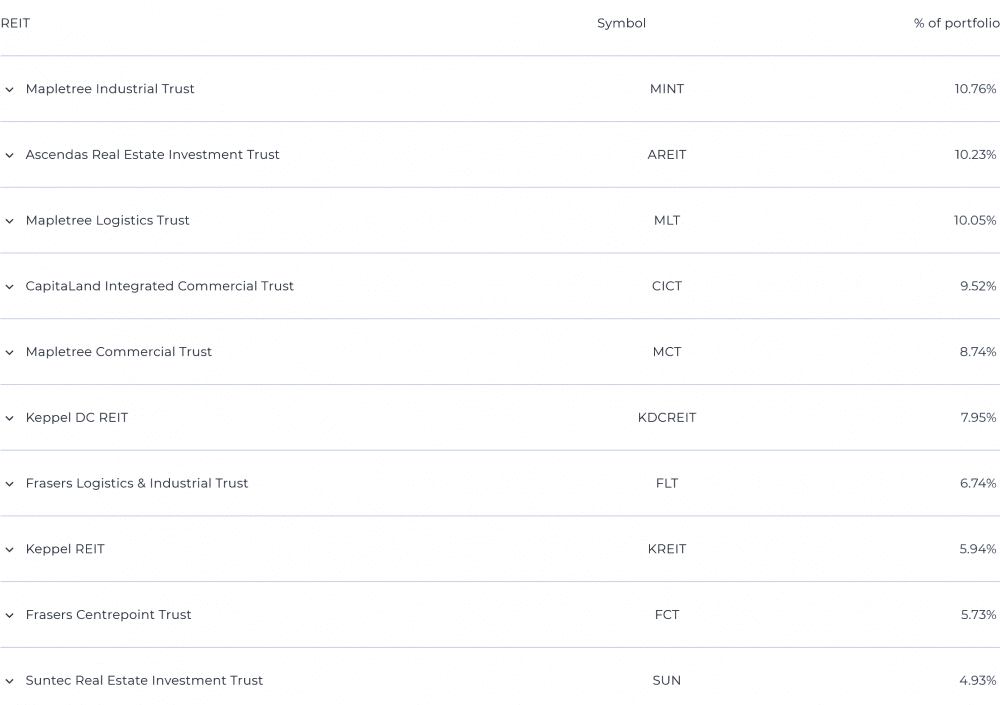

I notice the % of holding in the Syfe REIT+ portfolio differs from what they show in the Syfe Platform.

As of Aug 8 2021 – what I see is Top Syfe REIT+ portfolio is showing MINT @ 10.76% ; AREIT @ 10.23%; MLT @ 10.05%; CICT @ 9.52% & MCT comes # 6 at 8.74%

Can you please re-check this.

Hi AK,

Thanks! The screenshot has been updated.