Temasek Holdings is a private investment company headquartered in Singapore. It invests in private and public-listed assets spanning a broad spectrum of geographies and industries. As of 31 March 2021, its portfolio value stands at S$381 billion.

While Temasek is not a listed company that investors like us can buy into, it owns a significant stake in some of Singapore’s largest companies and its moves are closely watched by the investment community.

Temasek Review is an annual event where key executives present the company’s fund performance, portfolio allocation, and investment decisions taken over the year. Leading the presentation was Managing Director Fock Wai Hoong. This was followed by a Q&A session for Temasek’s panel of executives to address questions from the media.

Here are 15 things that I learned from Temasek Review 2021.

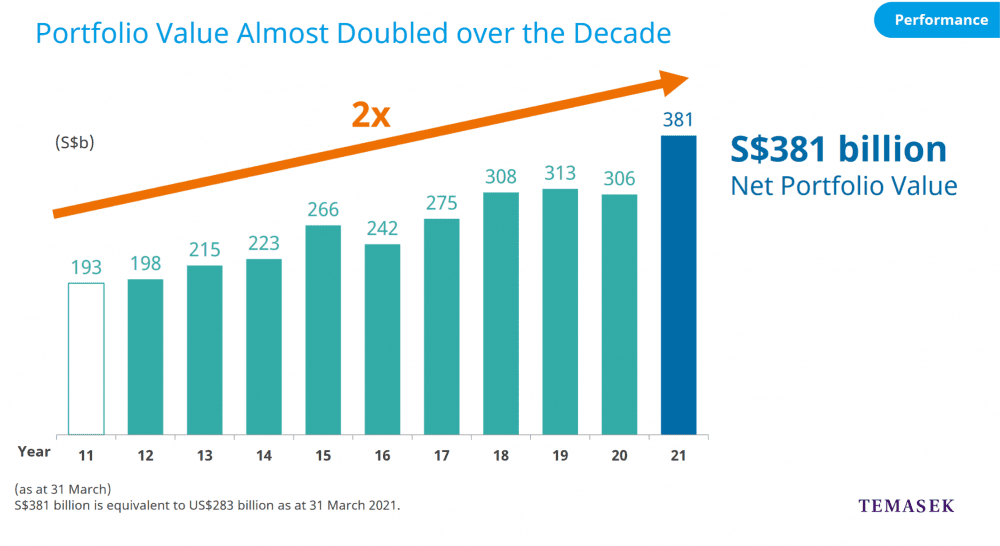

1. Temasek ended its financial year with a net portfolio value of S$381 billion, up S$75 billion over the previous year. Compared to 10 years ago, its net portfolio value has almost doubled.

In terms of investment activity, Temasek hit its highest record in a single year with both investments of S$49 billion dollars and divestments of S$39 billion dollars. Over the past 10 years, Temasek has invested S$276 billion and divested S$212 billion, which represents a net investment of S$64 billion.

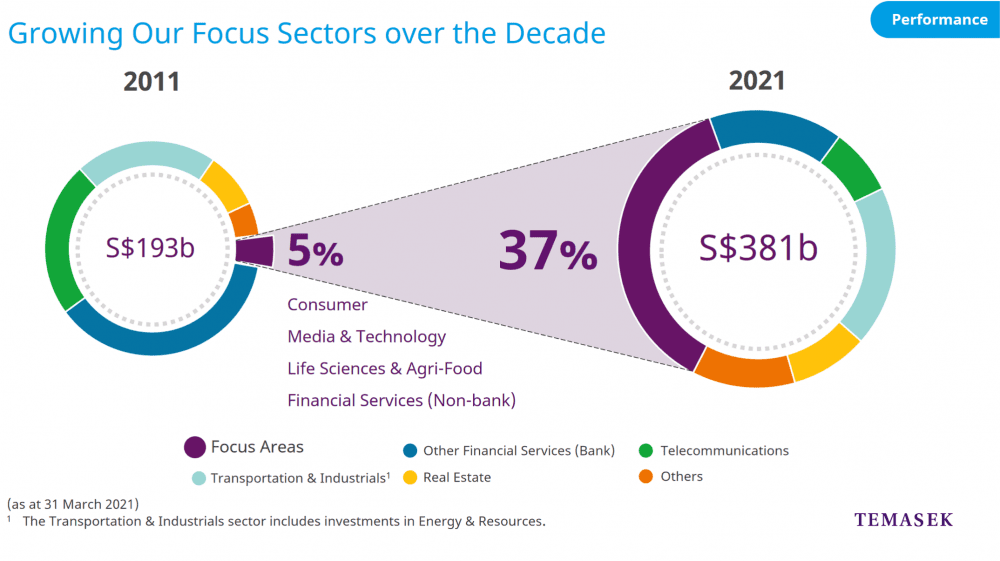

2. Temasek’s focus sectors of Consumer, Media & Technology, Life Sciences & Agri-Food, and Non-Bank Financial Services sectors have grown from 5% to 37% of its overall portfolio since 2011. This represents dollar value growth from less than S$10 billion to over S$140 billion.

Temasek’s position on structural and growing trends is reflected in the growth of its focus sectors and sector composition changes. On the changing composition within sectors, Fock shared that the Financial Services sector portfolio — which comprised entirely of banks previously — now includes Insurance, Fintech, and Payments which make up almost half of the Financial Service’s portfolio today. He added that Technology and Media companies now take up over half of its Telecommunications portfolio, while the Life Sciences and Agri-Food sectors have grown to 10% from 1% a decade ago.

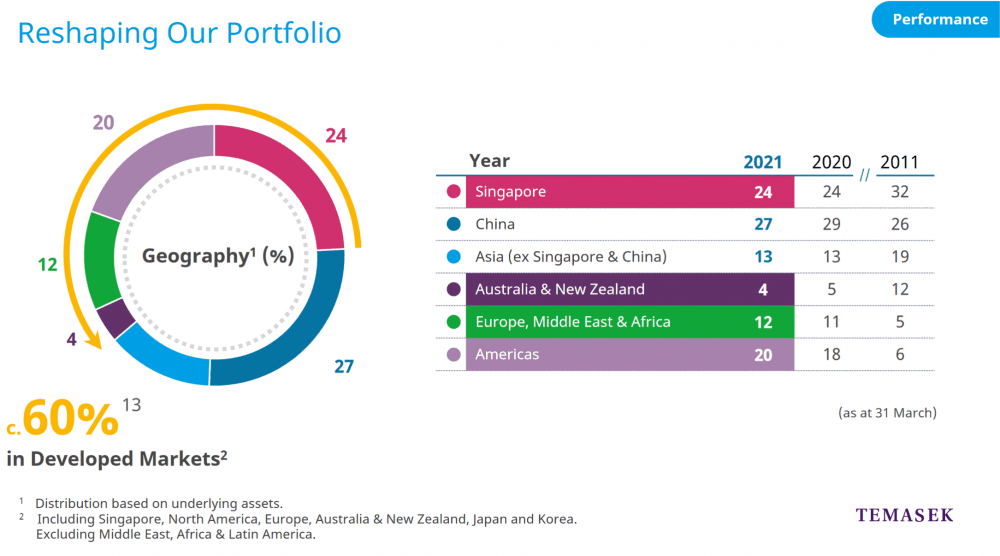

3. Singapore and China continue to be the Temasek’s two largest geographic exposures at 24% and 27% respectively, while exposure to developed economies has also increased to about 60% of the total portfolio.

Fock shared that Singapore’s percentage share of the total portfolio has declined compared to a decade ago. However, from absolute dollar terms, it has increased by 50% from about S$60 billion to S$90 billion. China’s exposure has remained constant at 27%. He explained that the increase in exposure to developed economies was mainly due to the growth of investments in Europe and the Americas.

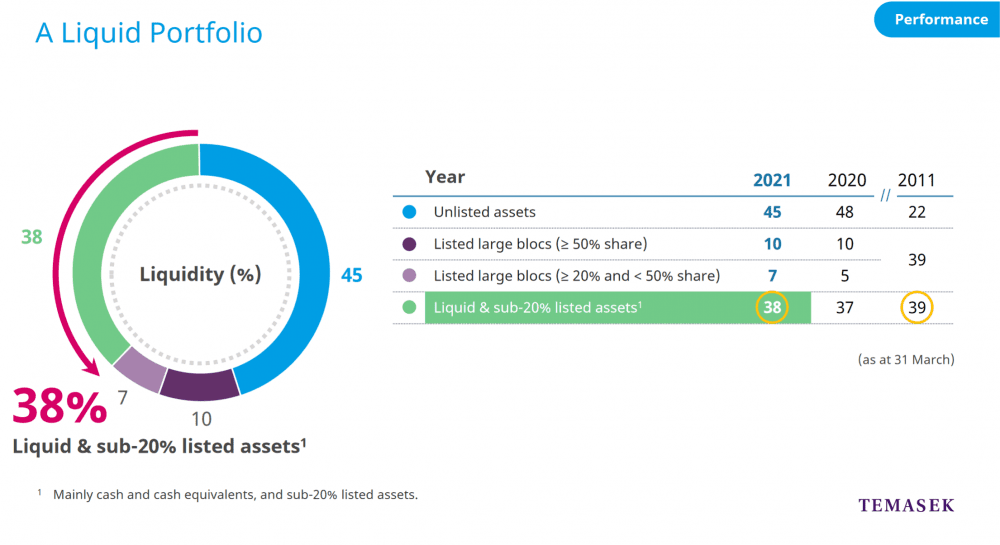

4. Temasek’s holdings in unlisted assets have grown from 22% to 45% since 2011, while liquid assets remain constant at 38% over the same period. Unlisted assets take up the majority of Temasek’s portfolio with liquid assets coming in second.

Fock said that unlisted investments have delivered strong returns over longer time horizons. He added that the liquid portion of its portfolio provides Temasek more than adequate cover for its bond obligations.

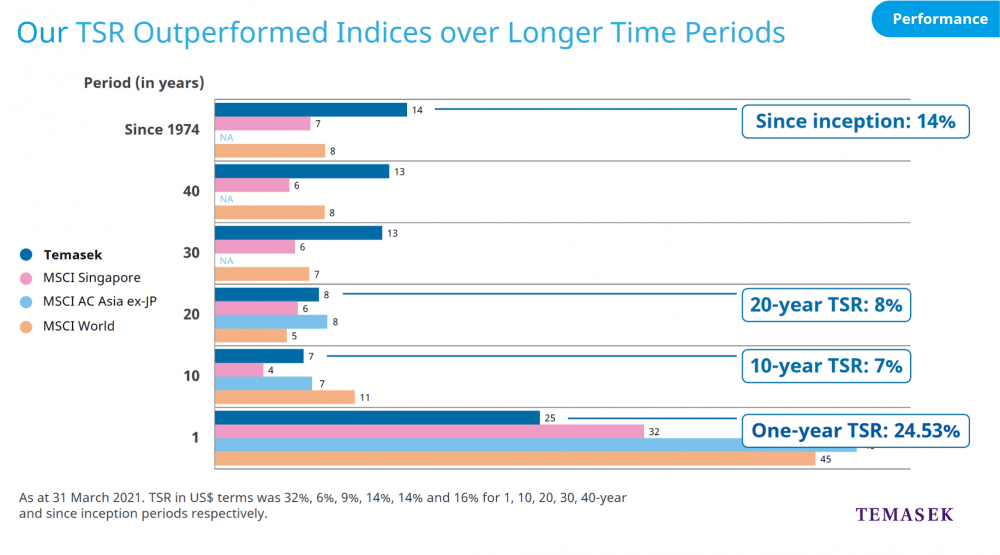

5. Temasek’s Total Shareholder Return (TSR) for the year was 24.53%. Its 10-year TSR and 20-year TSR is 7% and 8% respectively. Since inception in 1974, its annualised TSR is 14%. When compared against major indices, Temasek generally outperformed those indices over the longer timeframes (i.e., since inception and 20-year TSR).

While Temasek has presented these data for comparison, Temasek has emphasised that it does not manage its portfolio by public market benchmarks. In addition, Temasek’s portfolio includes investments in the unlisted space.

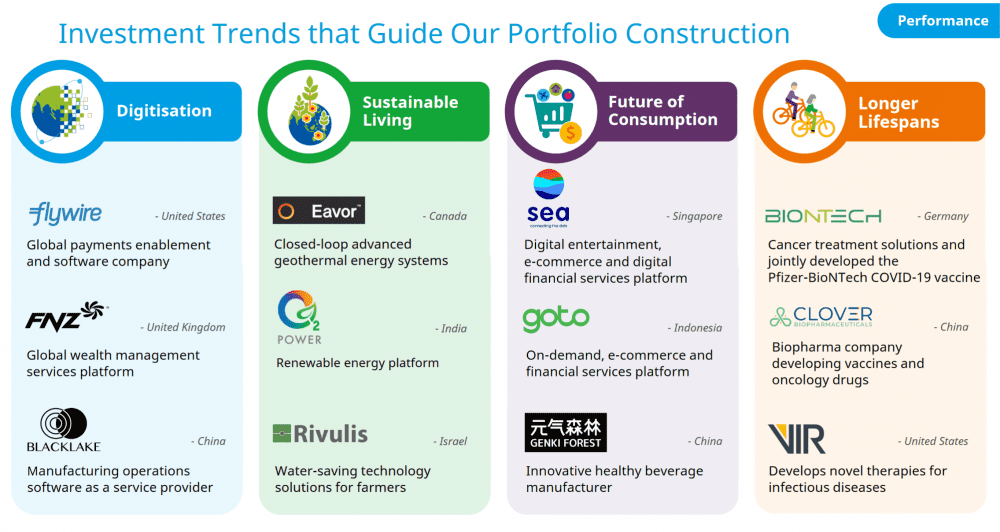

6. Temasek refreshed and sharpened its investment focus along four structural trends: Digitisation, Sustainable Living, Future of Consumption, and Longer Lifespans. Digitisation has been accelerated due to COVID-19 as business and consumers continue with online migration. The Sustainable Living trend supports the transition to a low carbon and more sustainable economy while the Future of Consumption trend anticipates structural shifts in consumption patterns of how consumers work and play. The Longer Lifespans trend focuses on lifecycle needs as people and societies live longer, fuller lives.

Temasek is increasingly shaping its portfolio in line with these four trends and have invested in companies that are developing innovative solutions to address these growing needs.

7. Temasek aims to reduce the net emissions of its portfolio to half of its 2010 levels by 2030, as part of its ambition of net zero carbon emissions by 2050. A three-pronged approach was mentioned by Mr Fock on Temasek’s ambition to achieve net zero carbon emissions.

Temasek will seek investments in climate-aligned opportunities and have partnered with BlackRock to establish a fund called Decarbonization Partners to invest in companies and technologies that will reduce or eliminate carbon emissions. Next, it will look towards enabling carbon negative solutions, such as carbon capture, utilisation and storage, as and when these become feasible. Its joint venture with Climate Impact X also offers a global marketplace for high-quality carbon credits. Thirdly, Temasek will continue to encourage decarbonisation efforts in businesses by stepping up engagement with its portfolio companies.

8. Temasek remains committed to China despite the regulatory crackdowns imposed recently by the Chinese government. Head of Public Affairs, Stephen Forshaw, said that regulations exist anywhere in the world Temasek invests in. Similarly, the Chinese government has determined the regulations for companies who operate in China.

He shared that Temasek’s investment in China is played towards the growth of the Chinese consumer. It is also investing more in early-stage tech and consumer companies. Some of these companies are operating in areas where regulations are still fairly new and not fully developed. Temasek accepts these rules and works within them as they would expect the companies they invest in to do so as well.

9. Temasek gave no insight on when Ant Group could resume its IPO. While Temasek cannot speak for the Ant Group on the listing moving forward, Forshaw said that Temasek invested in Ant as they believe in the fundamentals and thematic trends provided by the company, which they still do today.

While the plan for Ant’s IPO was suspended, Temasek does not necessarily lose out as they value their non-public portfolio companies at a conservative value. He cited Temasek’s investment in Alibaba (carrying them at book value) years before the company went public in 2014.

Forshaw added that Temasek’s China portfolio continues to do well, as they invest in companies at an early stage. While an IPO offers upside opportunity when a company goes public, he said that Temasek is not fixated on Chinese companies listing in the U.S. He shared that Temasek looks at different forms of monetization of its investments and will work within regulations as they change.

10. Temasek supported the decision of SIA to offer zero-coupon mandatory convertible bonds, as it would not be feasible for SIA to take up higher interest expense when it’s revenue is impacted during the pandemic. Forshaw acknowledged that it was going to be a struggle for SIA to maximise reach to retail shareholders as the convertible bonds were not paying a coupon, which is why there had to be an upside to participation (i.e., the conversion of bonds to equity).

Temasek’s position is that the company is facing a perfect storm not caused by their operations. Forshaw mentioned that SIA has been on a transformation programme prior to COVID-19 such as re-fleeting to replace old and less fuel-efficient aircraft.

Temasek views this situation as a time for it to lean in and help SIA weather the storm of COVID-19, and help the airline to invest in research, technology, and development of cleaner aviation fuel, so as to trail new products and arrive at the end of the tunnel well placed.

11. Nagi Hamiyeh, Joint Investment Group Head, said that weak oil prices and declining exploration budgets resulted in low orders for Sembcorp Marine. COVID-19 also hugely impacted the company’s manpower and procurement which led to the rights issue of $1.5 billion. He said the that the rights issue would enable Sembcorp Marine to be well-capitalised, strengthen their position in securing bigger contracts, and more importantly pivot to sustainable areas where Temasek sees a big future.

12. Hamiyeh said that while Temasek continues to monitor the tensions between the U.S. and China, both countries are important investment destinations for Temasek, and it will continue to invest in both geographies. More specifically, he said that Temasek’s investments in China is proxied by domestic growth and that the consumption, longer lifespans, and digitisation investment trends mentioned earlier are very prevalent in China. He added that Temasek does not look at import or export‑related companies, which minimises the magnitude of impact on its portfolio.

13. Hamiyeh said the day will come when quantitative easing by central banks would have to slow down, although it is still a guess and forward plans remain a decision with central bankers. However, Temasek believes there would not be any abrupt movement in the other direction. From its current perspective, Temasek believes inflation is transitory and could continue for the next year. However, this remains very much a viewpoint and subject to ongoing developments and fiscal spending decisions.

From a portfolio perspective, Temasek looks at the long term and does not recalibrate its portfolio on a month‑by‑month or year‑by‑year basis. Temasek believes that the portfolio is well-balanced between value, cyclical, and yield stocks, and will calibrate over time to sustain reversal in policies when they happen.

14. Temasek believes Japan is well positioned to benefit from a global cyclical recovery and is optimistic about its future prospects. In the near term, it expects positive economic activity to be driven by two factors: the improving pace of vaccinations, and continued support by the Bank of Japan. Over the medium term to longer term, it is encouraged by the Japan government’s efforts to accelerate digitisation, improve corporate governance, and achieve its climate change goals which could bolster productivity and mitigate future risks.

15. Temasek gave no indication on whether it would issue another retail bond offering soon. Fock shared that Temasek’s decision for bond financing is driven by three factors: 1) investment opportunities, 2) market conditions, which also include interest rates, 3) consideration of liquidity and gearing levels. He emphasised the importance for Temasek to manage its liquidity position and balance sheet strength and said that Temasek remain open and flexible to issuing new retail bonds.

The fifth perspective

Temasek adopts a long-term view of its investments. It invests across all stages of the business life cycle, from early stage/unlisted start-ups, to large or listed companies. For the retail investor, it may not be possible to fully replicate Temasek’s investment strategies and portfolio allocation. (e.g., participating in investments in early-stage companies or investing in companies of a specific geography.)

However, the company provides useful insight on global outlook and trends (such as domestic growth in China) as well as developments in local companies, such as the transformation and restructuring efforts of Sembcorp Marine, and Singapore Airlines. This information can provide the retail investor with insights on investment trends and evolving business models which can lead to potential investment opportunities when due diligence is done.