When it comes to streaming, the two biggest names in the industry are Netflix and Disney right now. Netflix, in particular, has been the poster child and stock market darling for the streaming industry for many years. Netflix pioneered the concept of streaming video entertainment over the Internet in 2007 and is the catalyst for the birth of the streaming industry as a whole.

Disney, on the other hand, is relatively late to the streaming game; it only launched its streaming service, Disney+, in late 2019 – a full 12 years after Netflix. Despite its late start, I would argue that Disney is the better streaming business to invest in for the long term. Here’s why…

Disney’s business model

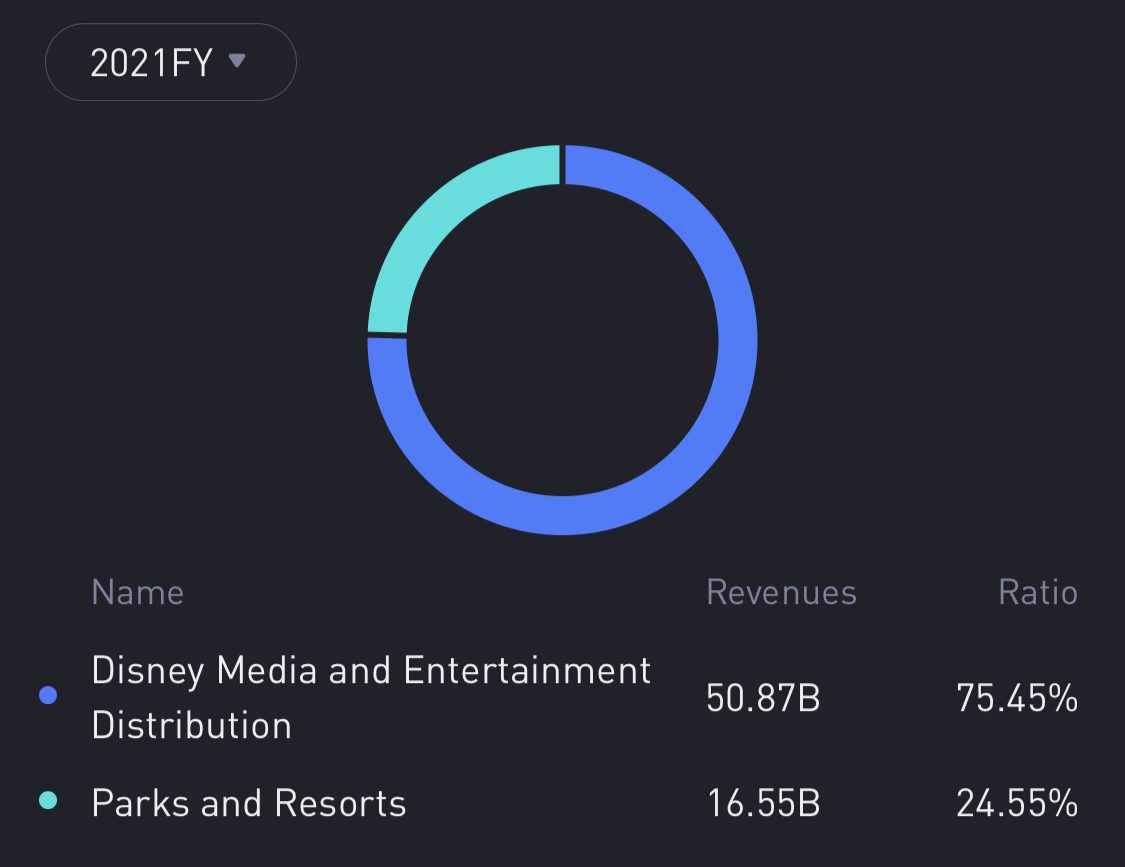

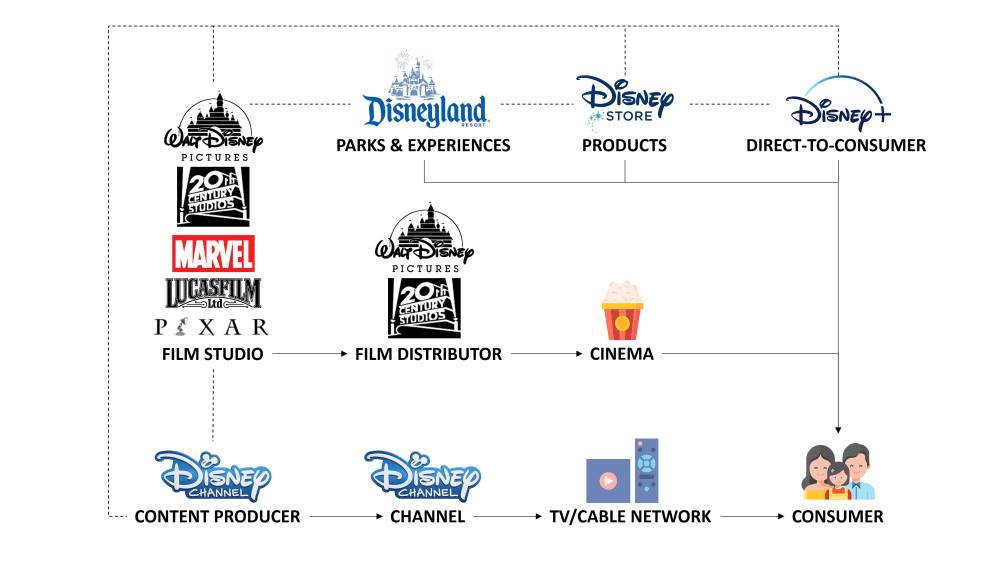

To see why Disney is arguably a better streaming company, you will first need to understand Disney’s overall business and a brief overview of its different business segments. Disney organises its company into two main segments: ‘Media and Entertainment Distribution’ and ‘Parks, Experiences and Products’.

These two main segments are then divided into several revenue-generating sub-segments:

Media and Entertainment Distribution

- Linear Networks. Comprises domestic and international television/cable channels including Disney Channel, ESPN, ABC, National Geographic, FX, Fox, Star, etc. This segment generates revenue from affiliate fees and advertising sales.

- Direct-to-Consumer. Comprises streaming services including Disney+, ESPN+, and Hulu. This segment generates revenues through subscription fees. This is also the segment that has garnered the most recent attention from investors and consumers alike.

- Content Sales/Licensing. Comprises TV/SVOD, home entertainment, music, and theatrical (movie) distribution. This segment generates revenue from the distribution/licensing of content to third-party television networks, movie theatres, home entertainment, and music markets. This segment also includes Disney’s Theatrical Group which produces live entertainment shows on Broadway and around the world.

Parks, Experiences and Products

- Parks & Experiences. Comprises Disney’s theme parks and resorts around the world (Disneyland, Disney World, Disneyland Paris, Shanghai Disney Resort, etc.), and Disney Cruise Line. This segment generates revenue from theme park admissions, merchandise, food and beverages, and room nights at hotels/cruises.

- Products. This segment generates revenue through the sale/licensing of Disney-, Marvel-, Pixar- and Lucasfilm-branded products including toys, apparel, games, home décor and furnishings, accessories, health and beauty, books, food, footwear, stationery, consumer electronics and magazines.

As you can immediately tell, Disney is a bigger and far more complex business than Netflix. Each of its segments are complete businesses in their own right with their own unique business models and revenue streams.

The business of storytelling

Although Disney is a massive entertainment conglomerate with many different business segments, they are all tied together by Disney’s ‘real’ business model: the business of storytelling.

‘People still love a good story, and I don’t think that will change.’

– Bob Iger, Chairman, The Walt Disney Company

If you look across Disney’s business segments, the success of each segment depends on the stories and characters we’ve grown to love over the many years and decades. The Marvel Cinematic Universe (MCU) is Disney’s most successful franchise to date with at least 10 films grossing over a billion dollars each at the global box office.

However, the success of the MCU isn’t limited to just movie ticket sales. Its success also flows over to consumers who subscribe to Disney+ to catch the latest MCU instalments; to families who flock to visit Disney’s theme parks to catch the latest MCU attraction; and kids who want to buy the latest MCU action figures and video games.

And this is not limited to just the MCU franchise. Disney also owns the intellectual property rights to Star Wars, X-Men, and Fantastic Four which can count on legions of fans from all over the world. Not to mention the countless Disney and Pixar films which have enchanted audiences over generations.

In my opinion, this is the key advantage Disney has over Netflix — for every hero/heroine, villain, and story that audiences have fallen (and will fall) in love with over the years, Disney has many ways for you to experience the ‘magic’ of that story over and over again. (The MCU being a prime example.) When it comes down to it, the success of Disney depends on capturing our imagination with its stories. And Disney, for most parts, is a master storyteller.

Danger to the king and queen

In the business of streaming, there’s a saying: ‘Content is king, but distribution is queen.’

Disney is the king of content; its library of intellectual property is the best in the world. Now with Disney+ and its other streaming channels, Disney is also the queen of distribution. When Disney+ first launched in November 2019, Disney set a target of reaching 90 million subscribers by 2024. As of April 2022, Disney already has 137.7 million subscribers, smashing past its original target way in advance. Disney now has a target of reaching 230 million to 260 million subscribers by 2024.

Despite the apparent tailwinds in the streaming industry, there are certain risks to consider as well. Netflix saw its number of subscribers drop for the first time in 10 years when it released its Q1 2022 results — a sign that growth could be slowing in an industry that’s seeing increasing competition.

Besides Disney+ and Netflix, consumers can also pick from a growing list of streaming platforms including Amazon Prime Video, Apple TV+, HBO Max, Paramount+, and Peacock among others – each with their selection of exclusive movies and TV shows. With such a fragmented market and your favourite shows locked behind various streaming platforms, consumers are experiencing ‘streaming fatigue’ and piracy is now on the rise again.

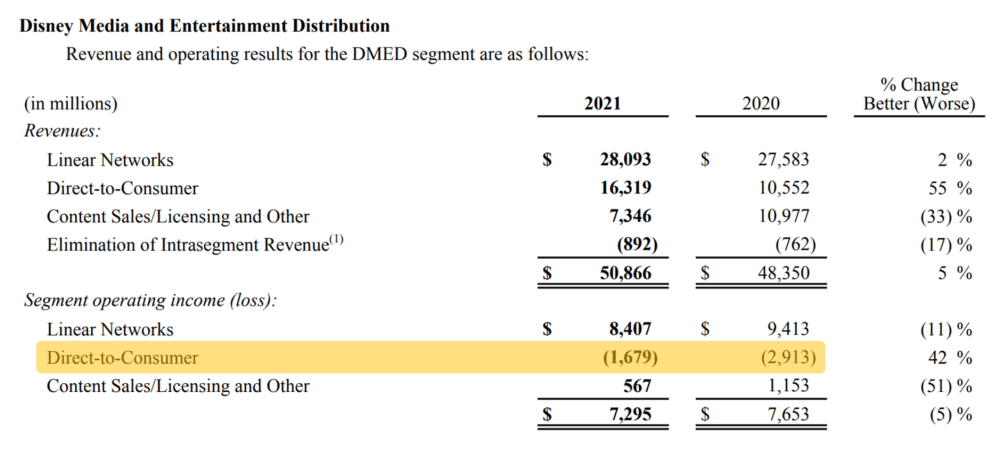

Another thing to consider is that although Disney’s Direct-to-Consumer segment is growing strongly, it is still unprofitable. However, losses are narrowing, and the segment is expected to turn a profit by 2024 as it continues to scale up.

At the same time, the growth in Direct-to-Consumer will also be partly offset by the declining Linear Networks segment as its viewership declines due to cord-cutting.

The fifth perspective

With is diversified business model and revenue streams, Disney is a more resilient company than Netflix. (In comparison, Netflix’s only main revenue stream is its streaming subscriptions.) Disney owns the best intellectual property in the industry and has multiple channels for consumers to experience the magic of Disney (or Marvel, Star Wars, Pixar, etc.). The return of crowds to Disney’s theme parks and cruises will also be a near-term boost as the pandemic eases.

Conversely, some investors may highlight Disney’s declining Linear Networks segment and the capital and labour-intensive nature of its theme parks which will offset the growth of its streaming business. As with any investment, it’s important to perform your due diligence and value Disney’s stock accordingly.

Trade Disney, Netflix, and other U.S. stocks for $0 commissions on Tiger Brokers! Online trading platform Tiger Brokers (Singapore) has introduced the launch of its lifetime zero commissions campaign for unlimited trades on U.S. stocks for users. When you open an account with Tiger Brokers, you also receive one free Grab share and a chance to win one free Tesla share.

With commission-free trades, users can better capitalise on small price movements in the market and unlock cost savings with more efficient trading using Tiger Brokers’ (Singapore) trading platform. Investors new to trading can also benefit from access to U.S. markets at a lower cost.

One account for global markets. Trade efficiently with Tiger Brokers’ intuitive and robust platform – whether you are a beginner or a professional – including stocks, ETFs, options, warrants, CBBCs, REITs, futures, and funds. You can also link your Tiger Brokers account to TradingView to access powerful charting tools and connect with a network of traders.

The online trading platform currently has over 9 million registered users worldwide. Tiger Brokers holds a Capital Markets Services License under the Securities and Futures Act 2001 by the Monetary Authority of Singapore (MAS).

Open your Tiger Brokers account today. *Terms and conditions apply.

This article was written in collaboration with Tiger Brokers. All views expressed in the article are based solely on The Fifth Person’s independent opinion.

The content is provided for entertainment & informational use only. The information and data used are for purposes of illustration only. No content herein shall be considered an offer, solicitation or recommendation for the purchase or sale of securities, futures, or other investment products. All information and data, if any, are for reference only and past performance should not be viewed as an indicator of future results. It is not a guarantee for future results. Investments in stocks, options, ETFs, and other instruments are subject to risks, including possible loss of the amount invested. The value of investments may fluctuate and as a result, clients may lose the value of their investment. Please consult your financial adviser as to the suitability of any investment. This advertisement has not been reviewed by the Monetary Authority of Singapore.