The yield curve, which plots bond yields across various maturities, has reached its most inverted level in over 12 years amid rising trade tensions between the United States and the rest of the world. As expected, this sparked renewed recession chatter on many mainstream media platforms. It is easy to see why — every U.S. recession over the past 60 years has been preceded by an inversion of the yield curve.

This isn’t the first time we have seen aggressive media coverage on the topic. Back in mid-2018, American media sources started writing about the yield curve as it started flattening. At the same time, The Fifth Person editor-in-chief Adam Wong wrote a fantastic primer about yield curves that can be found here.

It is this renewed interest in the yield curve that set me thinking about the seemingly airtight relationship between yield curve inversions and recessions.

Why does such a relationship exist, and is the relationship really as indisputable as the laws of gravity? More importantly, should you be worried about your portfolio if the yield spread falls further into negative territory?

An inverted yield curve is driven by two phenomena: pessimistic economic sentiment and Federal Reserve intervention to subdue inflation. In this article, I will go through each of these factors before coming to a conclusion.

The driver of yield curve inversions

One driver of yield curve inversions is the sentiment of market players. As investors and businesses turn pessimistic about the prospect of long term economic growth, they tend to purchase long term bonds in anticipation of further declines in yield. Long-term bonds offers the opportunity to lock in interest rates at current levels, which is especially attractive as opposed to short-term bonds that are exposed to interest rates fluctuations.

We saw sentiment turn negative once again in May 2019, after U.S. President Donald Trump announced his intentions to impose tariffs on neighbouring Mexico. Mexico is one of the United States’ largest trading partners, and the impacts of a tariffs are far-reaching, especially on the automobile and industrial goods sectors. This stoked fears about a possible economic slowdown, given that higher costs of goods would result in lower profits for companies and lower consumption of goods at the same time.

However, sentiment of market players do not directly lead to recessions. Negative sentiment can cause short-term market corrections as market players turn excessively pessimistic, but such forces are not sufficient to cause a full-fledged economic downturn. The shape of the yield curve needs to be considered in the context of current economic conditions.

Economic booms and the Fed’s hand

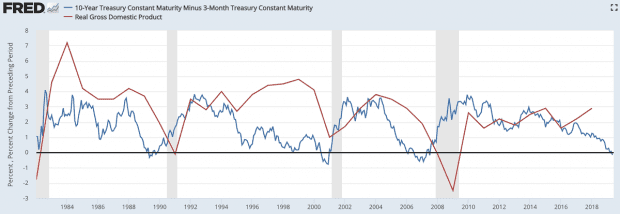

Yield curve inversions tend to occur towards the end of economic cycles as the economy is booming and reaching full capacity. As seen in the chart below, inversions happen in the final stages of economic expansions, right before the economy enters into a recession.

Why does something like this occur? The answer lies with the way that the Federal Reserve deals with inflation, one of the hallmarks of strong economic growth.

In theory, excessive consumer optimism leads to increased production of goods as businesses produce more to satisfy demand. As this occurs, competition for resources increases, which leads to an increase in the cost of goods. This creates price inflation as businesses pass on some of those higher costs to consumers.

While low inflation is generally regarded as positive, excessive inflation can cause some pretty devastating effects, especially if it deters consumers from purchasing more goods. Take the United States, where double-digit inflation was followed by a deep recession in the 1970s. When consumers cut back on spending, businesses are stuck with inventory that they cannot clear, leading to a reduction in both investment and production — a recipe for economic disaster.

This is the reason why one of the Federal Reserve’s main considerations when it manages the country’s interest rate policy is inflation. In a bid to prevent rampant inflation and overheating, the Federal Reserve raised its policy interest rate nine times between 2015 and 2018 as the economy staged a strong rebound following the 2008-2009 financial crisis.

However, the Federal Reserve has limited control over interest rates. It manages the Federal Funds Rate, which is the rate banks charge to each other for very short-term overnight loans. These loans are usually used to satisfy the liquidity needs of banks and rarely last more than a week.

This means that every time the Federal Reserve raises or reduces interest rates, it is only setting short-term rates. On the other hand, the Federal Reserve has little to no control over long-term rates, which as mentioned above, are set by market forces. This explains why the yield curve tends to invert in the face of a booming economy that is reaching full capacity.

Inverted yield curves and recessions

This leads us to the million-dollar question: How does all this tie in with recessions?

Past recessions had a diverse range of causes, from wage controls in the 1973-1975 recession, to the imprudence of savings and loan banks in the 1990-1991 recession. The two most recent recessions — the 2001 recession and the Great Financial Crisis of 2008-2009 — were triggered by falling asset prices. The former was caused by the dotcom bust, while the latter was caused by a sharp plunge in housing prices.

Finding the cause of the next recession is a tall order, but reviewing the causes of past recessions indicate that inverted yield curves do not directly cause recessions. As seen above, they are better used as a reflection of the economy’s current position in the economic cycle.

However, there is something that relates inverted yield curves and recessions together. Recessions are usually a product of asset bubbles, the imprudence of market players, or both. Things like asset bubbles only surface in times of economic prosperity — which happens to be what inverted yield curves reflect.

The fifth perspective

Contrary to popular belief, inverted yield curves do not cause recessions. Nevertheless, they indicate that we are at a stage in the economic cycle that suggests a higher likelihood of recession, particularly if asset price bubbles are left unchecked.

While we should not throw caution to the wind, inverted yield curves should not be a cause to abandon all positions and run for the hills. Continue to hold great businesses that can reliably generate growing cash flows over the years. However, this is also a good time to review your portfolio to clear stocks that may react badly to a recession.