In my previous article, I covered eight long-term growth drivers Hatten Land has in its favour and why the stock is in my portfolio. But as with any investment, there are always risks to consider. It is financially dangerous to invest in anything without exploring the possible downside.

So in this article, I want to balance the views I shared in my first article and list four risk factors you need to know about Hatten Land:

1. Prolonged recession and counterparty risk

A prolonged recession will impact Hatten’s financial position, and potentially compromise the integrity of its sale-and-leaseback scheme. The current economic upswing will come to an end one day, and when the economy sinks into a recession, Malacca’s tourist numbers and its investors’ confidence will definitely be affected. This will directly affect take-up rates of Hatten’s new properties, reducing the company’s revenues and affecting its financial position.

A more serious risk that Hatten may face during a prolonged recession arises from its sale-and-leaseback model. While I mentioned that this model grants Hatten increased financial flexibility and the ability to benefit from any after-market increases in property prices, this arrangement will work against Hatten in a recession. Due to the rental payments guaranteed to the clients who purchased properties under the scheme, Hatten will be forced to continue making its payouts in the event that one or more of its tenants defaults on its debt and shuts down. This will only aggravate the financial effects of the recession on the firm, potentially causing the company financial troubles.

However, it is assuring to know that Hatten has taken precautions against such a scenario. According to its annual report, it attempts to seek out reputable lessees both to ensure interest from customers, and to reduce the risk of their lessees running into financial trouble. In addition, it limits the term of such sale-and-leaseback agreements to two years for more volatile retail units, and up to nine years for more stable master leases of hospitality properties. While these precautions do not ensure that the company is recession-proof, it does limit the counterparty risk undertaken by the company in guaranteeing payment of rent to the buyers of its property.

2. Substantial related party dealings

Hatten’s business model also involves a substantial number of related party transactions. While Hatten regularly engages in joint ventures with its parent company and sponsor, Hatten Group, this arrangement is relatively common in property development companies and REITs in the region. The more concerning related-party dealings are those between Hatten and its primary contractor for construction of its development properties, Montane Construction Sdn Bhd.

According to Hatten’s 2016 prospectus, the company incurred RM285.9 Million in construction costs payable to Montane in fiscal 2016. This sum represented 90% of Hatten’s operating costs in fiscal 2016. There are a few concerns that investors should be aware of. The company mentioned that transactions were “not on normal commercial terms due to there being no independent quotes received”. The absence of cross-checking opens up the possibility that Hatten may be overpaying for its construction services, which is definitely a negative for investors in Hatten. While the prospectus mentions international construction consultancy firm Langdon & Seah confirms that such charges are reasonable, the fact that Hatten exclusively hires Montane for all its projects means that the company does not actively evaluate other contractors, potentially causing it to miss out on contractors that may do a better job for a comparative or lower price. On the flip side, however, Montane has proven to be a reliable contractor, as there have not been any major problems or delays related to Hatten’s projects so far.

3. Bumiputera discount

The Malaysian government requires property developers to give a discount on properties to bumiputeras, which a term used to describe native Malay residents. Developers must set aside a portion of units in each residential or commercial property for bumiputeras, and this discount can range between 5% and 15%. This bumiputera quota does vary based on a development’s location, but it does not change the fact that units reserved for bumiputeras might potentially be harder to sell due to its smaller target customer base.

4. Currency risk

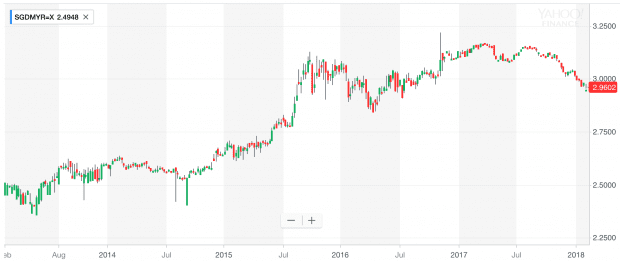

At the moment, all of Hatten’s operations are conducted in Malaysia, which uses the Malaysian ringgit. As seen in the graph below the Malaysian ringgit has depreciated by 15.7% against the Singapore dollar from 2.4948 to 2.9602 per dollar over the past five years.

However, as shares are listed in Singapore, any depreciation in the ringgit against the Singapore dollar will impact earnings and share prices which are denominated in the Singapore dollar.

It is noteworthy that even in the case that the ringgit depreciates, the company will not be affected as it will be reinvesting all earnings into other Malaysian projects, and will likely never convert any cash to a foreign currency unless it decides to expand overseas at some point.

Conclusion

Over the longer run, Hatten’s current and planned developments are poised to benefit from large projects that increase Malacca’s attractiveness as a tourist destination and a business hub, such as the Singapore-Kuala Lumpur High Speed Rail and the Malacca Gateway Project.

However, investors in the company need to be aware that Hatten is taking on risks than the traditional property developer. Beyond the typical geopolitical and development risk, a large sum of Hatten’s business transactions take place between related parties. Additionally, it also faces risks related to its sale-and-leaseback business model. In exchange for accelerating sales of its commercial property and retaining the ability to control its tenant base, it has taken on RM375 Million in rental obligations to its customers. Even though most of its units are rented out under a master lease agreements to financially stable tenants, Hatten could come under substantial financial stress in the case that one or more tenants default on their obligations.

Is VGO still have influence on Hatten Land placement price 28c last year now become nearly 55% discount in a year.Are SSH sell any shares that from this price declind

Thanks for sending in the question!

VGO was Hatten’s vehicle in securing a listing on the Singapore market without going through a normal IPO. During the reverse acquisition, VGO management’s share in the company was reduced to merely 7% of the combined entity. There isn’t publicly available data on whether the owners of the original VGO sold their shares post-reverse takeover, but I suspect the impact of such sales would not be a significant driver of prices going forward.

I have a unit in Hatten Suites, this year 2018 two rental payment delay second half of the year. Dont seems to look good to me

Hi. I also invested in Hatten and I did not receive payment for months. I was told that that is a group for Hatten’s owner. Are you in it? I would like to join the group!

Hi , is there any current or latest price estimation or revision of Hatten Suites if I intend to buy or sell.

Hi Beng Hong,

I’m not familiar about the going rates of specific units offered by Hatten, but according to what I have seen on the ground and in the annual report, they are facing some difficulties selling their units to investors. When I was in Malacca, I observed multiple showrooms with salespeople working till pretty late at night (10pm+). While that doesn’t mean much in itself, its recent earnings report (for 2Q 2019) showed that gross profit margins halved as a result of higher discounts and rebates offered to purchasers. This is a sign of oversupply setting in, so I’d avoid investing in property in the region if I were you.

Hi Kang Wei,

Great analysis. Do you have an updated evaluation of Hatten group’s financial or cashflow position? I do notice signs of trouble as Harbor city construction is very slow and not meeting the schedule. Also notice poor occupancy of the new shopping mall. And negative news of Hatten Land getting an extension of SGD20M loan repayment to Haitong. Any chance of the company going bust and abandoning project ?

Hey Sip Ping,

I don’t actively follow the company anymore but a quick look at their financials indicate they have slowed their pace of investment significantly. Cash flows over the past few quarters have been positive predominantly because of a reduction in working capital (ie. they are taking money out of the business). They do have a high debt load so I think some of those funds will be going towards paying that debt down. I don’t have enough information to comment on whether they may be going bust but I agree that progress on multiple projects are now behind schedule vs the projections 2-3 years ago.

Hi, last month I had just brought a retail Unit at Harbour City mall and I had pay a deposit, should I cancel the Purchase ?