Hatten Land is a property developer focused on developing residential, hospitality and commercial real estate predominantly in the state of Malacca. Hatten Land (SGX: PH0) listed on the Catalist board on 28 February 2017 at 29.5 cents per share. Since its listing, however, Hatten Land’s share price has fallen over 40% to 18 cents (as at 12 April 2018). The company also posted a RM74 million loss in its most recent quarter (albeit mainly due to large one-off expenses).

Despite its tumbling share price and recent quarterly loss, I’ll explain why Hatten Land is still in my portfolio and remains potentially attractive. In this two-part article, I will share my analysis on Hatten Land and cover its business model and growth factors before balancing those views with the potential risks.

Please note that my research is meant for educational purposes only and should not be construed as investment advice or a recommendation of any kind. My aim is to help you understand the company better and how I evaluate a property developer like Hatten Land.

Business model

Hatten generates its revenues through the sale of these development properties to its customers. According to its 2016 prospectus:

“[Our core business] as a property developer is to sell all developed units in order to maximise economic benefit. [We] do not intend to own any units in its own developments.”

A portion of the company’s sales are completed through sale-and-leaseback arrangements with their customers. Under such arrangements, Hatten first sells a unit to its customers, and following that, it signs an agreement to provide a certain amount of rental yield (currently 6% of purchase price) to its customers every year for a committed rental period that varies from one development to the next. The company then leases this unit to either its parent company, the Hatten Group or a third-party lessee that will pay Hatten Land rent. A significant portion of this sum will be paid to the buyer of the unit as rental yield, and the remaining sum will be shared by Hatten Land and a third-party property agent (if any).

This business model makes sense as it allows Hatten Land to free up capital that would otherwise have been tied up in the property. This allows it financial flexibility to fund other projects, to accumulate cash, or to pay down its debts. It is also a significantly more efficient way for Hatten to finance its capital-intensive development projects, especially since Hatten’s cost of debt is approximately 7% due to Malaysia’s high base lending rate of 6.7%. One final benefit of such a structure is that it enables Hatten to take advantage of any after-market price appreciation its units experience. Under Hatten’s traditional business model where it aims to sell all its developments, it will not benefit from any rental escalation as prices of its properties increase.

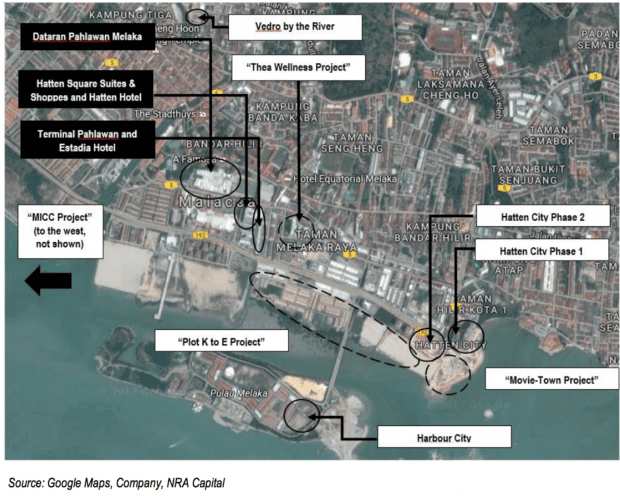

At the moment, Hatten Land is developing six different property projects, which are named Hatten Phase 1, Hatten Phase 2, Vedro By The River, Satori, Harbour City and the Malacca International Convention Centre (MICC) Project. These projects range from standalone commercial properties such as Vedro By The River and Satori to integrated developments such as Hatten Phase 1 and Hatten Phase 2. In such integrated developments, commercial, residential and hospitality properties are constructed in close proximity to each other, effectively building an ecosystem in which customers are shared between individual properties. The image shown below, courtesy of equity research firm NRA Capital, shows the exact locations of Hatten Land’s properties in Malacca:

As at 30 June 2016, Hatten Land’s development portfolio (excluding MICC) has a total market value of RM1.9 billion with an aggregate gross floor area of approximately 7.8 million square feet.

Growth drivers

Despite its recent bad news, Hatten has a number of long-term growth factors, particularly macro ones, in its favour. These factors would potentially help drive strong sales for Hatten’s projects in the near future. Here are eight growth drivers for Hatten Land:

1. Strong sales for existing projects

Hatten recognises its revenue based on the percentage of completion method. This means that revenues and costs are recognised progressively, with reference to the property’s stage of completion. Consequently, Hatten is unable to recognise much of the revenues from new launches until the development’s construction progresses to a more advanced stage.

As of Q1 2018, Hatten recorded RM760 million in unrecognised revenue, predominantly originating from the company’s Harbour City Project, which has seen strong sales but is only 15% completed, as well as the Satori project, which is already over 70% sold despite being launched just last year. This measure demonstrates that sales of Hatten’s projects have been healthy, and it provides visibility of revenues and earnings that will be recognised over the next three years when the two projects reach completion.

2. Ability to secure high quality land parcels in Malaysia

Hatten Land has access to 22 undeveloped land parcels with a total area of 9.2 million square feet for future development through its Right of First Refusal (ROFR). According to Hatten Land’s 2016 prospectus:

“Through the ROFR and Call Option granted to the Company, we are able to periodically review whether such land parcels and development rights held by the Hatten Group would be suitable for property development.”

As seen in the quote above, the company were granted these rights by its parent company, Hatten Group, which either owns the entire land parcel or the development rights to the land. These rights enable Hatten Land to purchase development rights to the land when it deems fit. At the same time, the company possesses preferential access to purchase a certain piece of land in the scenario that a third-party firm is interested in acquiring the same plot of land. Besides allowing Hatten Land to raise its return on capital employed by being asset-light, this beneficial arrangement ensures that the company is removed from any risks related to holding the land banks.

3. Remarkable track record and brand recognition

Hatten Group, the parent company of Hatten Land was born when the founders, brothers Dato Colin Tan and Dato Edwin Tan acquired a 19-acre abandoned mall project in 2005. Situated in Bandar Hilir, opposite popular Malaccan mall Mahkota Parade, this abandoned mall was within walking distance to famous landmarks such as Portuguese fortress A’Famosa. After one year of further construction, Malacca’s largest shopping mall, the Dataran Pahlawan Melaka Supermall was unveiled by the Hatten Group in 2006. The Pahlawan has only gained in popularity since its completion, with a 2014 article estimating that it receives 11 million visitors every year.

Similarly, Hatten Group has grown to be the dominant property developer in Malacca over the years, successfully completing a flurry of other well-received developments following the Pahlawan. The most noteworthy of which was the Hatten Square Suites and Shoppes, an integrated development with a hospitality arm (Hatten Hotel) and a retail arm (Hatten Square). Located next to the Pahlawan, the Hatten Hotel is now the largest and one of the most popular hotels in Malacca. Since its completion in 2012, the hotel has always occupied a spot on the list of top Malaccan hotels, and according to a management comment, it maintains a remarkable 80% occupancy rate year-round while being managed internally.

Hatten Hotel. Source

While these properties are not part of Hatten Land, which houses exclusively the property development arm of Hatten Group, it demonstrates the group’s foresight and its exceptional ability to develop quality properties. Besides this remarkable track record, the fact that Hatten already has some presence in Malacca creates brand recognition for its future projects. Buyers of residential properties and potential lessees of retail units are definitely more confident working with a developer that has proven itself in earlier developments in the region.

4. Malacca’s favourable demographic trends

A number of Malaysia’s current demographic trends makes investment in residential property attractive. Firstly, the low median age of Malaysians will keep demand for property high. The median age of Malaysians is 28.1 years, one of the lowest in Asia, translating into a high number of potential property buyers and strong demand for rental properties. In addition, there are currently 4.3 people living in each Malaysian property. This figure is comparatively higher than its regional neighbours like Indonesia, which has a ratio of 3.9, as well as Singapore and Thailand- both with a ratio of 3.2. As Malaysia develops over the next few years, this ratio is likely to fall, which again translates to higher property demand over the next few years.

However, two factors that may hamper demand for property is an excessive supply of residential property as well as overhyped property prices, both of which are not of serious concern in Malacca. To determine whether there is an oversupply of property in Malacca, I used two metrics: the amount of existing property stock in Malacca compared to its population, and the amount of incoming and planned property stock as a percentage of existing property stock.

Malacca’s existing property stock amounts 173,400 which represents 3.44% of the existing total stock in Malaysia. Its population, on the other hand, makes up 2.8% of Malaysia’s total population, translating into a ratio of 1.21. This implies that there is a relative oversupply of property in Malacca compared to Malaysia as a whole. However, this figure compares favourably to other cities in Malaysia, as seen in the table below. This ratio is 1.61 for Kuala Lumpur, 1.48 for Penang and 1.28 for Johor. While the ratio for the “Others” segment is a mere 0.67, it includes data for relatively undeveloped and less affluent regions in Malaysia.

| (in '000s) | Kuala Lumpur | Selangor | Johor | Penang | Malacca | Others | Total |

|---|---|---|---|---|---|---|---|

| Existing Stock (2016) | 460 | 1,420 | 744 | 409 | 173 | 1,832 | 5,038 |

| Stock % of Malaysia | 9.13% | 28.19% | 14.77% | 8.12% | 3.43% | 36.36% | 100.00% |

| Population (2016) | 1,790 | 6,290 | 3,650 | 1,730 | 900 | 17,230 | 31,590 |

| Population % of Malaysia | 5.67% | 19.91% | 11.55% | 5.48% | 2.85% | 54.54% | 100.00% |

| Relative Over/Under Supply | 1.61 | 1.42 | 1.28 | 1.48 | 1.21 | 0.67 | 1.00 |

| Incoming Stock | 80.9 | 203.2 | 200.3 | 95.9 | 32.1 | 368.0 | 980.4 |

| Incoming as % of Existing Stock | 17.59% | 14.31% | 26.92% | 23.45% | 18.55% | 20.09% | 19.46% |

| Planned Stock | 92.9 | 107.5 | 188.8 | 51.0 | 14.8 | 253.5 | 708.5 |

| Planned as % of Existing Stock | 20.20% | 7.57% | 25.38% | 12.47% | 8.55% | 13.84% | 14.06% |

| Total % Planned & Incoming Stock | 37.78% | 21.88% | 52.30% | 35.92% | 27.11% | 33.92% | 33.52% |

Another metric of note in the table above is the total planned and incoming stock of property as a percentage of existing stock. As seen in the table above, the incoming and planned developments amount to 27.1% of existing stock. This figure is derived from the sum of Malacca’s properties in development (18.55%) and its planned developments (8.55%). These figures compares well to most other cities in Malaysia, and is well below the Malaysia average. On a side note, this data also explains why Johor’s property market is lacklustre at the moment. With many local and international developers investing crudely in areas such as the Iskandar district, the total percentage of planned and incoming stock has reached a massive 52.3%, even though there is currently no serious oversupply (ratio is 1.28 as seen earlier).

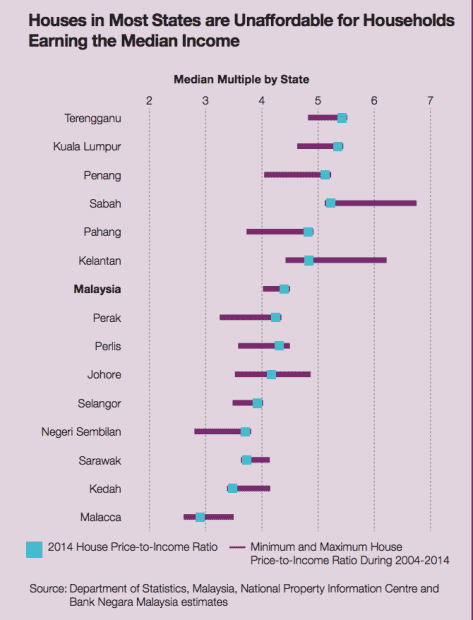

Next, let us look at property prices in Malacca as compared to properties in other regions in Malaysia. The chart below, taken from Bank Negara Malaysia’s 2016 annual report, compares the affordability level of different states in Malaysia.

Price-to-Income Ratio for Malaysian States. Source: BNM 2016 AR

The chart measures affordability based on the Price-to-Income ratio, which is simply the median house price divided by the median income level in the region. As seen in the chart below, the average price-to-income level in Malaysia was 4.4 as of 2014, with some states with an even higher ratio, including Kuala Lumpur and Terengganu- both states have ratios above 5.0, denoting severe unaffordability.

On the other end of the spectrum, areas like Malacca, Kedah and Sarawak have comparatively lower ratios, with Malacca having the lowest ratio of just 2.98. While this can be partially attributed to Malacca’s higher median monthly household income (RM5,029 as compared to national average of RM4,585), Malacca’s attractive property prices will ensure that there is a steady demand for properties from locals. At the same time, low property prices will be a key attraction for foreign investors looking to invest in Malaysian properties.

5. Supportive Malacca government

The Government of Malacca has put into place a number of schemes to aid property development companies financially. While there is no publicly available information on the specifics of these schemes, Hatten Land recorded a one-time reimbursement of RM27.6 million in fiscal year 2017. This was attributable to the grant it received from the Malaccan government upon completion of Hatten City Phase 1 for development costs it incurred as part of the project.

6. Malacca’s strong growth in tourist receipts

Malacca was a town that was well sought after in history. Over its 600-year history, Malacca was controlled by various global powers. It was first governed by Parameswara, the former ruler of Singapore who fled to the city in the 15th century. It was also during this period that Chinese Admiral Zheng He stopped over several times in Malacca during his maritime voyages. Just a century later in 1510, the Spanish took control of the city by force, before losing control of the city to the Portuguese in 1641 after a lengthy four-decade war. It was then ceded to the British in 1824, before gaining independence as part of modern-day Malaysia in 1957. Its position as a colonial town with cultural elements from not just the Malay Archipelago, but also China and Europe positions it well as a key tourist attraction in the region.

Malacca’s undeniable position as a strong tourist attraction is attested to by its strong growth in tourist arrival numbers over the past decade. Tourist receipts to Malacca has grown at a compounded rate of 10.5% over the between 2007 and 2016, from 6 million to 16.28 million. This number is even more impressive when one considers that the total tourist arrivals for the whole of Malaysia was 26.8 million for 2016, which implies that 61% of all tourists who visited Malaysia also visited Malacca at some point in their trip.

These impressive tourist arrival figures will undoubtedly bring benefits to Malacca’s property market. The effect of increased tourist numbers will be most acutely felt by the hospitality industry, through the increase in demand for hotel rooms. Malls and other retail outlets will also reap the benefits of increased tourist traffic in the area. With Hatten Land focusing on integrated developments and mixed-use projects with a combination of not just residential but also retail and hospitality properties, the company is poised to benefit from the increase in tourist figures through developments such as Hatten City Phase 1 and Harbour City.

7. Future projects make Malacca more attractive

There are several projects that will make Malacca more attractive to not just tourists but also investors within the next ten years.

Firstly, the expansion of Malacca’s airport and planned increases in the number of routes to and from Malacca will make the city more accessible. While Malacca’s airport was built in 1952, annual traffic is still miniscule at 58,000 as of 2016, mainly due to the fact that it currently only serves two airlines with routes to Pekanbaru (Riau, Indonesia) and Penang. In 2017 January, Malacca’s government announced plans to expand its runway by over 500 metres to accommodate larger aircraft. Just half a year later, AirAsia CEO visited the airport, announcing that they are mulling commencing operations of AirAsia in the Malaccan Airport. While it will take a considerable amount of time and effort to increase travellers’ awareness about the airport and to induce more airlines to operate in Malacca International Airport, this is a positive development that will benefit Malaccan property developers like Hatten.

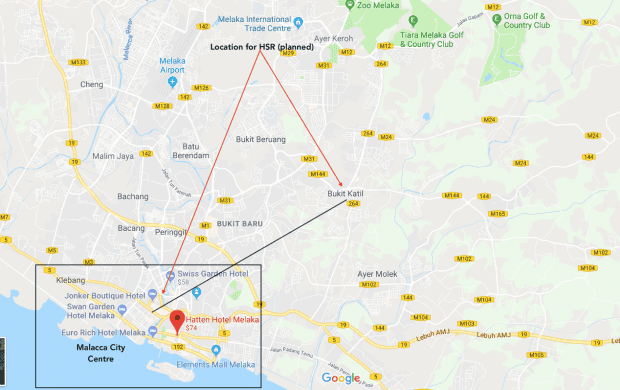

Additionally, another project that will potentially increase traffic in Malacca is the high speed rail connecting Singapore and Malaysian capital Kuala Lumpur. Slated for completion in 2026, this project will drastically decrease in the amount of time required to travel to Malacca from both Singapore and Kuala Lumpur. In fact, it will reduce travelling time from Singapore to Malacca from three hours (by car) to just thirty minutes. On the other hand, travelling time from Kuala Lumpur will decrease from two hours to twenty minutes. While it takes 25 minutes to travel from the railway station to the city centre, this project reduces travelling times from these two large cities tremendously, likely inducing tourists interested in the region to include Malacca in their itineraries.

Another possible growth driver for Malacca would be the Melaka Gateway Project, which is a RM40 Billion project consisting of four offshore reclaimed islands, which will be positioned beside Pulau Melaka. Each island serves a different purpose in the project’s overall aim to enhance Malacca’s attractiveness as both a tourist destination and as a business hub. The first island, slated for completion within the next 2 years, is an entertainment island, which will contain a ferry terminal, a Ferris wheel, a theme park and a heritage village. The other three islands, with completion dates ranging from 2018 to 2025, consists of a port, an industrial park and a business district. Financed predominantly by Chinese investors, this is clearly a bid to make Malacca not only more attractive to tourists, but also as a business hub. This will undoubtedly bring more traffic to Malacca, especially along with the other projects mentioned above.

8. Developer activity reaffirms Malacca’s potential for growth

Hatten Land is not the only property developer bullish about Malacca’s future prospects. In fiscal year 2017, Malacca saw increased land acquisition activity. A few of the most noteworthy transactions includes a partnership between Encorp Berhad and Sinmah Capital Berhad to develop 78 acres of land in Bukit Katil into a development worth nearly RM900 million. However, as compared to Hatten Land’s prime land parcels (most are facing the sea or in Malacca’s city centre), these locations are much less appealing. As seen in the screengrab from Google Maps below, Bukit Katil is closer to the planned location of the of the high-speed rail but is inland and quite a distance from Malacca’s city centre.

This leads me to believe that while some might have concerns that increased developer interest might cause an oversupply of properties, Hatten already has an advantage by owning many prime plots of land that will benefit most from an increase in investor demand. In fact, increased interest from other developers might even serve to create joint venture opportunities for Hatten, and foreign investors will likely serve to raise prices of property in the region, which is still very affordable as mentioned earlier.

In my next article, I’ll cover Hatten Land’s risks and what you need to watch out for.

I am keen to invest who can I contact?

Hi Abdul,

Please note the article should not be construed as and does not constitute financial, investment or any form of advice, and is strictly for educational purposes only.

Any investment involves substantial risks,including complete loss of capital. You are advised to perform your own independent research before making any investment decisions.

Thanks! 🙂

Hi Abdul,

Please read this as well:

https://fifthperson.com/hatten-land-risks/

Dear Mr. Ong & the Fifth Person team,

Kudos on a very insightful and thorough read. Thank you for featuring our Hatten Land Limited in your piece. I am from the Group Corporate Communications dept of Hatten and we would like to request permission to share your article on our social media pages.

Thank you,

Sonia

Hi Sonia,

Yes, of course. You’re most welcome to share the article 🙂

Thank you very much. I invested 2 units in Hatten Suites and 2 shop houses in Melaka. Thus any Melaka development I will be very interested. Thanks for keeping me posted in the future

Just to add on:

Hatten Land is helmed by Dato Colin Tan June Teng, who holds the post of Executive Chairman and Managing Director, as well as his brother, Dato Edwin Tan Ping Huang, Executive Director and Deputy Managing Director. Both in their 30s, they are relatively young but they have established themselves as a capable management team from the fact that they expanded Hatten from a fledgling property development company with just one plot of abandoned land in 2006 to what it is today.

I appreciate the fact that the founders- Colin and Edwin Tan retain a large majority stake of 82.61% in the company through their interest in Hatten Group Holdings. This ensures that they have skin in the game and are therefore more likely to act in the interest of shareholders.

If you want to become a full time property investor though, you will need to be unique in every way. It is not enough to simply not want to … Note the term ‘full time investor’. Thanks for sharing the blog post!

Dear sir,miss,

Was it the selling price for each unit with same size n feature was not the same. It seem to my perceptions selling prices depending on each sales rep. I did inquire for silverscape but seen pricing not the same n so i stop there.

Before you invest Hatten Group, do your home work, and check whether their property prices are overpriced. Also, even they guarantee you a certain rental yield per year, this not a bullet proof plan. What if the developer/company goes down? You do not get any rental, you are still left with a huge amount of mortgage payments to clear, and you are just holding on to a worthless unit.

I have invested in their unit, and have been experiencing late rental payments. It happens quite a few times, and it is really tiring asking from them. Have been wondering whether they met with any financial situations.

Agree with William. Currently Hatten printing the Vouchers to pay the rental without informing investors.

True, this company is not worth believing. I also experiencing rental delay now

Anyone who is thinking of investing in Hatten Group projects should take a look at Capitsl City at JB.

It might save you some headaches and your hard earn money.

Invested in a unit by Hattens. Project was more than 2 years late. Finally was asked to take possession. After taking possession, found major defects including leaking. Have been trying for 18 months to get them to rectify the defects to no avail. Emails after emails went ignored or just arrowed to this and that person who simply says,”We will look into it” with nothing done for 18 months. Till date, defects still not rectified and the unit is still unliveable with loss of rental income, time and stress. This developer and company has no future. All look rosy from the outside with all those awards but gone case. Is there a legal case to sue? Anyone?

sorry that hear that.

why not try to rectify the defect yourself? (provided they are minor not major) at least after done that you can start renting out and collect rent…