KIP REIT (Bursa: 5280) is a Malaysia retail REIT that was listed on Bursa Malaysia in February 2017. KIP REIT’s IPO comprised 13.5 million units to the public and 220.65 million units to institutional and selected investors. There was overwhelming demand from the retail public as the offer was oversubscribed by 5.07 times. KIP REIT’s IPO price of RM 1.00 per unit went as high as RM1.04 on the day of listing. But it has since tumbled to RM0.86 as of 8 January 2018.

Despite the poor performance so far, the management led by Datuk Chew Lak Seong still plans to grow the REIT to RM$1 billion in market cap by injecting five new properties over the next three to five years. KIP REIT currently owns six properties located around Malaysia at Johor, Negeri Sembilan, Melaka and Selangor. The total asset value of the REIT is RM614 million as of September 2017.

Here are seven things to know about KIP REIT before you invest:

1. KIP REIT is a retail REIT that aims to differentiate itself with its concept of ‘KIP Mart’. A KIP Mart is a one-stop community-centric retail centre focused on mass market retail. Each KIP Mart has a wide range of retailers including wet markets, convenience stores, supermarkets, general merchandise stores, food courts, boutiques, telecommunication shops, jewellery shops and more. It also provides facilities such as money changers, ATMs, push-cart kiosks, and family entertainment areas. The REIT currently has five such community-centric retail centres (KIP Mart) and a neighbourhood retail centre (KIP Mall).

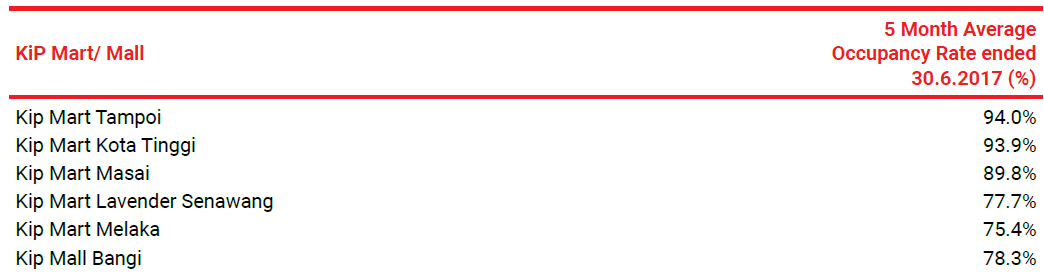

2. The average occupancy rates for KIP Mart Tampoi, Kota Tinggi, and Mart Masai are around 90% and above due to successful asset enhancement initiatives and tenant retention. The lower occupancy rate for KIP Mall Bangi is due to the withdrawal of the bowling alley and the use of short-term tenancies at KIP Mart Lavender and KIP Mart Melaka.

Source: KIP Annual Report 2017

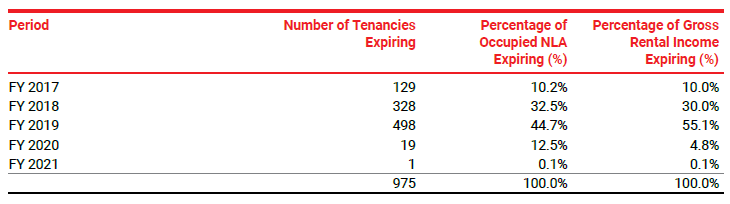

3. KIP REIT’s tenancy expiry profile is not well spread out and faces a risk of tenancy expiry concentration. More than 75% of occupied NLA is expiring in 2018 and 2019, which represents 85% of gross rental income. The management has to work very hard to renew the expiring tenancies or to win new tenants in these two years.

Source: KIP Annual Report 2017

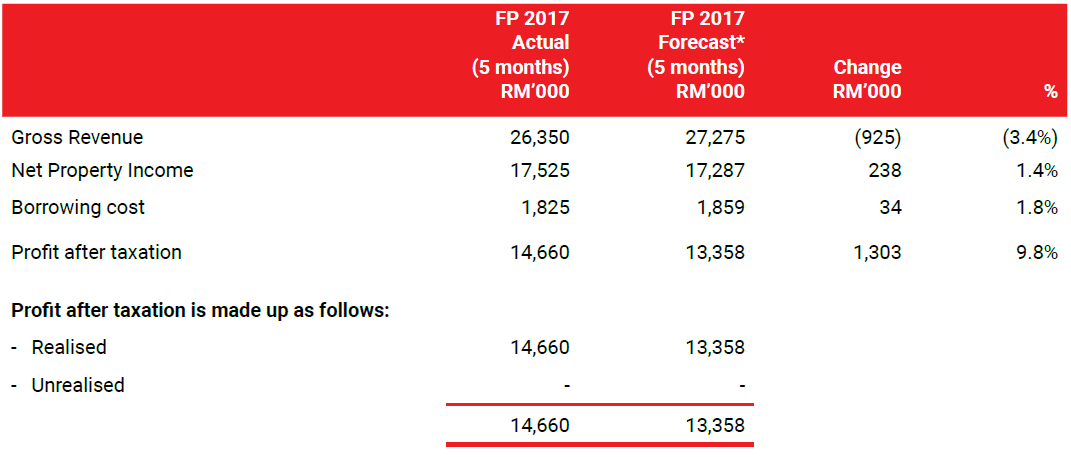

4. KIP REIT reported a slight decrease of 3.4% in gross revenue compared to its 2017 forecast. The was due to short-term tenancies at KIP Mart Lavender Senawang and KIP Mart Malacca, and the withdrawal of Superbowl at KIP Mall Bangi as mentioned above. The relocation of existing tenancies in the mezzanine floor at KIP Mart Tampoi also contributed to the lower gross revenue. However, as a results of cost savings and positive rental reversions at KIP Mart Masai, net property income was higher by 1.4% compared to the forecast.

Source: KIP Annual Report 2017

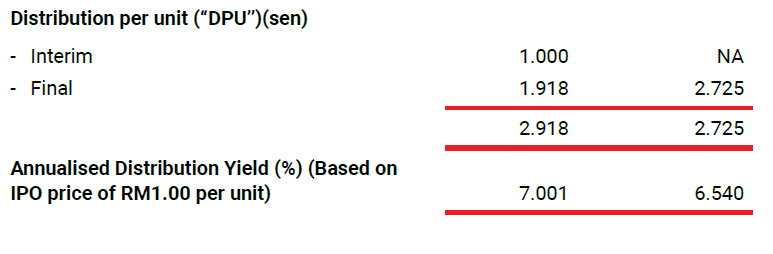

5. As promised to unitholders, KIP REIT distributed 100% of its distributable net income for the period ending 30 June 2017 — a total payout of RM14.74 million. When annualized, KIP REIT’s has a dividend yield of 7.0%, which is higher than the Malaysian retail REIT average yield of 5%-6%.

Source: KIP Annual Report 2017

6. As at 30 June 2017, KIP REIT has a gearing ratio of 14.2%. This means the REIT has a debt headroom of RM220 million before reaching the gearing limit of 50%. When opportunities arise, the REIT will be able to acquire assets without needing to request additional funds from unitholders. KIP REIT’s current borrowings are fixed rate term loans at 1.25% interest per annum for five years.

7. Manging director Dato’ Chew Lak Seong and executive director Dato’ Ong Kook Liong are the co-founders of KIP Group of Companies, the sponsor of KIP REIT. Chew has over 35 years’ experience in property development and investment, hospitality, and retail development. Ong has over 27 years’ experience in sales and marketing of properties, property investment, and hospitality. They have a very good relationship as they have known each other for at least 25 years while working with MBf Property Services.

The fifth perspective

Most retail REITs target the big boys and reputable retail chains as their major tenants but KIP REIT has differentiated itself by offering one-stop community-centric retail centres targeting mass market consumers.

Moving forward, KIP REIT holds the right of first refusal for the acquisition of five properties from its sponsor which including purpose-built retail centres to house the KIP Mart concept. The management may also explore other third-party properties should they meet the investment criteria of the REIT.

At this moment, KIP REIT’s occupancy rate for its portfolio is not impressive. However, it is too early to make a call as the REIT was listed less than a year ago and the management needs to be given time to prove their abilities in managing the REIT.

With additional article contributions by Calvin Soon.

I would like to correct the author that the interest rate on the borrowings for the REIT is not 1.25% per annum as stated but rather 5.3%.

Hi Nicholas, For the borrowing interest rate, we derived it from the KIP REIT 2017 annual report under Total Borrowing on page 12. You can refer to the annual report. Thank you.