How share buybacks work: 3 things to watch out for when a company buys back its shares

You may have come across the term ‘share buyback’ (or share/stock repurchase) a few times before and wondered how a buyback affects your stock investment. Investors often view share buybacks as a positive move as it typically increases value for shareholders.

But what is a share buyback and how does it work?

A share buyback is a company buying back its own shares from the open market or directly from individual shareholders, thereby reducing the total number of outstanding shares in the market. Other than dividends, companies usually use share buybacks as a way of returning money to shareholders. So how does it do that and increase value for shareholders like you and me?

How share buybacks increase shareholder value

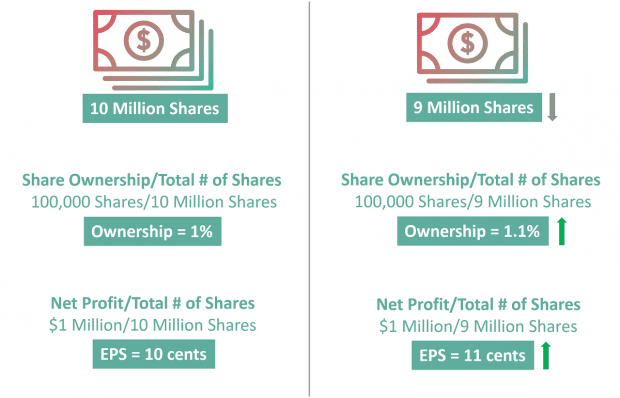

For example, let’s say a company has 10 million outstanding shares on the market and you own 100,000 shares — this means you own 1% of the company.

Let’s say the company also made a net profit of $1 million and paid a total dividend of $500,000 — this means the company’s earnings per share (EPS) is 10 cents and its dividend per share (DPS) is 5 cents.

If the company buys back one million shares, it now only has nine million outstanding shares. Because of this, you now own 1.1% of the company. You now own a larger stake in the company and your shareholder value has increased.

Since the company has a lower number of outstanding shares, its EPS also rises to 11 cents and DPS to 5.5 cents. On a per-share basis, the company is now making a higher profit and shareholders receive a higher dividend.

As you can see why, investors tend to view share buybacks favourably. Share buybacks are a way of indirectly returning money to shareholders, and the higher EPS and DPS is often recognised by the market which pushes the company’s share price up in the short term.

Reasons for share buybacks

Strong share buybacks could be a signal that the company is confident in its business and is willing to reinvest its cash to purchase its own shares. In a nutshell, the management is saying: “We don’t see any better investment than ourselves.” (Although this may be true, this is not always the case.) However, some investors may view this negatively and think that the company has run out of other growth options.

A company may also repurchase its shares when it genuinely thinks they are sufficiently undervalued. If a company’s shares are undervalued, buybacks are often the best use of capital, even when there are other growth opportunities out there.

For example, if the stock is trading at $1 but its intrinsic/fair value is $2, the management is only spending a dollar to buy two dollars’ worth of value – that immediately generates a return of 100%. Even if the company had a growth opportunity that could generate 80% returns elsewhere, repurchasing the undervalued shares would still generate a higher return and is therefore the better choice.

How share buybacks destroy shareholder value

However, a share buyback doesn’t always mean shareholder value is created or that the management has the shareholders’ best interests in mind.

Here are three things to watch out for when a company buys back its shares:

1. Buying back shares when they are overvalued. Just like how shareholder value is created when a company repurchases shares when they are undervalued, the reverse is also true when shares are overvalued. For example, if the share is trading at $4 but its fair value is $2, then the management is effectively paying double to buy a dollar’s worth of value; this destroys shareholder value. If a stock is overvalued, it is better for the company to return cash to its shareholders via dividends instead of buybacks.

2. Buying back overvalued shares using debt. If buying overpriced stock is bad enough, buying overpriced stock using debt is worse. It’s bad enough paying two dollars for a dollar of value, except now you also owe two dollars to someone else! If a company has the cash reserves, it shouldn’t need to borrow the money to do a share buyback. (And if it doesn’t have enough cash at all, then a buyback is out of the question!) However, there is an instance where it may make sense for a company to use debt to finance a share buyback – when the shares are sufficiently undervalued. As long as the company isn’t overleveraged, using debt to repurchase undervalued shares may be justified.

3. Buying back shares to create a false market. By now, it should be clear that a company should always look to buy back its shares at the lowest prices possible. However, some companies may use share buybacks to create a false market to mislead investors. For example, a company may excessively buy back its shares at increasingly higher prices to artificially inflate its trading volume and price. The management could also buy back shares at higher prices near the market close in an attempt to push up the closing share price.

The fifth perspective

Share buybacks, in general, are good news for shareholders. However, investors should watch out if the management is using buybacks to boost its ratios and/or share price — especially even when the company’s shares are overvalued. Remember, good management and great capital allocators will only repurchase shares when their price is trading below fair value.

Watch out for bad management! Here are 5 management red flags you need to watch out for before you invest in any stock.

The article is knowledgeable. Company buyback its shares which may increase the value of shares.

Thanks!

Dear Fifth Person,

I have a few doubts with the share buyback by a company. Hope you could clarify them.

My questions are:

1. Why would a company buyback its overvalued shares just to create a false market? What gain would it get?

2. Will the share buyback amount being shown in the Cashflow statement?

3. Is my understanding correct that the share buybacks will be treated as treasury shares?

If so , the Company can use them as share options to reward employees, acquisitions, bonus issues?

4. Following question 3, can the company sell its treasury shares in the open market especially when its share is overvalued?

5. Is there a limit number of shares that the company can buyback? If so, is

it based on a yearly basis?

Thank you and looking forward to your guidance.

Grace

Hi Grace,

Great questions! To answer them:

1. A company with a higher share price is worth more.

2. In the cash flow statement under financing activities.

3. The company can either retire the shares or list them as treasury shares. Yes, the company can use treasury shares and reissue them for employee share schemes.

4. The company can reissue treasury shares as common stock which it can then resell on the open market. This is why some companies buy back shares when they are undervalued and then reissue them when the share price is higher.

5. No, there is no limit unless the company sets an internal policy. The company also needs to have enough outstanding shares in the market or it may fail to meet the minimum free float requirement set by the exchange.

Dear Adam,

Thank you for your prompt reply.

For replies to questions 3 & 4, may i know the circumstances under which the company reissue its buyback shares besides reissuing them for employee share scheme?

Can they be used for the following scenarios:

(a) Bonus issue?

(b) As a payment for acquiring a company?

(c) Private placement?

Co buyback shares from the market –> become Treasury Shares of Co –> Number of outstanding shares of Co in the market is reduced, hence EPS is up.

(d) Co reissue treasury shares for the above scenarios –> the number of outstanding shares of the Co in the market is increased, hence no of shares is diluted and EPS is decreased?

So when we look at EPS ratio per se, the abovesaid scenarios could be one of the factors affecting EPS?

So sorry for the many questions. Thank you so much and really appreciate your coming clarifications.

Always learning from all of you,

Grace

Hi Grace,

No worries. Thanks for asking your questions here so everyone else can read and learn from them as well! To answer your questions:

The company can reissue the shares as and when it likes, and use them as it sees fit. Your a, b & c scenarios are just some examples.

Yes, reissuing new shares will dilute ownership and decrease the EPS.