Recently, I took a look at the top 30 blue-chip stocks that form the FTSE Bursa Malaysia KLCI and compared their total returns over the past decade (from 2010 to 2019).

After some analysis, I was surprised to find out that these are the three best performing Malaysia blue chips over the past 10 years:

| Stock | Opening Price (4 Jan 2010) | Closing Price (31 Dec 2019) | Capital Gain | Dividend Income* | Total Return (Capital Gain + Dividend) |

|---|---|---|---|---|---|

| Press Metal Aluminium Holdings Berhad | RM0.22 | RM4.65 | 2,013.6% | RM0.30 | 2,151.7% |

| Hap Seng Consolidated Berhad | RM0.81 | RM9.98 | 1,132.1% | RM2.39 | 1,427.0% |

| Hartalega | RM0.52 | RM5.48 | 953.8% | RM0.42 | 1,035.2% |

*Based on dividend income between FY2010 and FY2019

These three companies come from different industries. If one had bought any of these stocks ten years ago and held on until now, he would have netted a ten-bagger in their portfolio. But of course, this is only in hindsight.

Anyway, let’s run through the three stocks that did the best in the Malaysia stock market.

Press Metal Aluminium

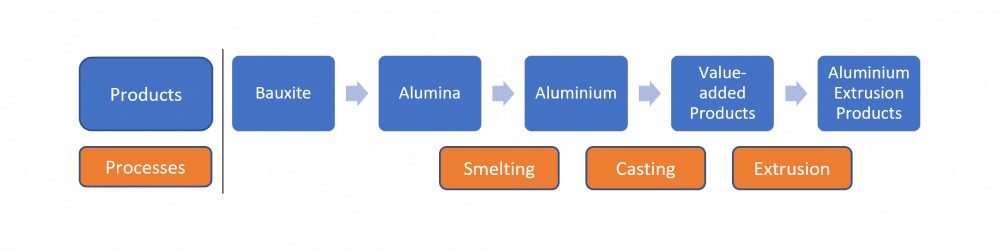

Press Metal is the largest aluminium producer in Southeast Asia. It is involved in the smelting, casting, and extrusion processes as shown below. Its plants are located in Malaysia and China while its aluminium products are exported across the world through the South China Sea.

Value-added products such as billet, alloy ingot, and wire rod generally have higher margins then primary aluminium ingot. Here are some key facts about Press Metal:

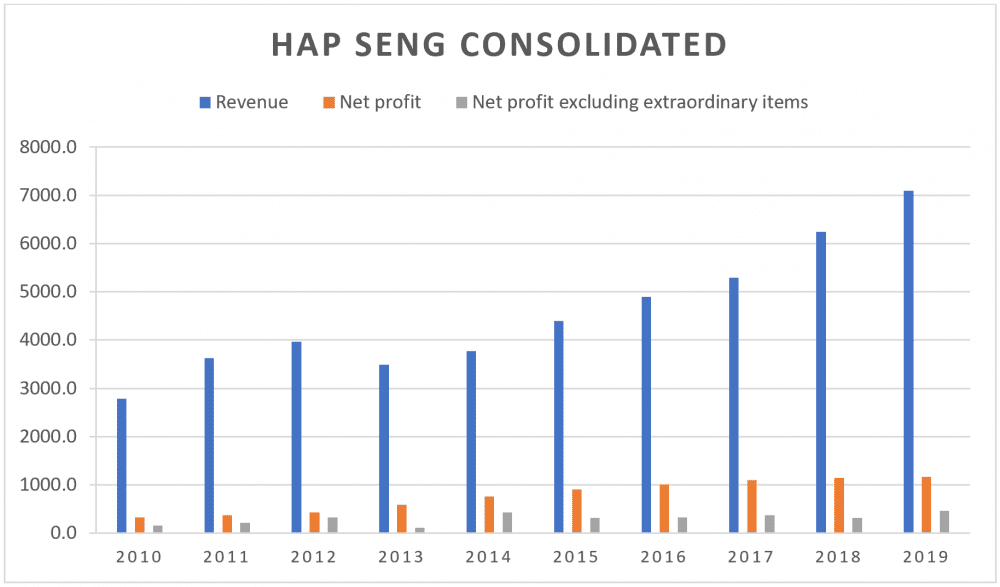

1. Press Metal has been ramping up its smelting and extrusion manufacturing capacities in Malaysia over the past 10 years. These expansions have seen its revenue and net profit record compound annual growth rates (CAGR) of 20.1% and 34.0% between 2010 and 2019 respectively.

2. The company’s business is affected by aluminium prices. It posted net losses after adjusting for extraordinary items in 2013 and 2015 because of weak aluminium prices. Over the past 10 years, its operating cash flow was only negative in 2011 and 2012 as there were sharp declines in trade and other receivables. In 2019, the total-debt-to-equity ratio stood at 1.0, which is less-than-ideal.

3. Aluminium is a commodity and Press Metal has to be one of the lowest-cost producers of alumimum in order to compete with its peers. It entered into a long-term power agreement with the Sarawak State’s power company to secure (probably cheaper) stable electricity supply.

4. The proposed third aluminium smeltering plant in Sarawak will boost its smelting capacity by 42.1% to 1.1 million tonnes. In the past two years, it tried to secure its raw material supplies by venturing into upstream alumina production to cater to its enhanced smelting capacity. An associate that supplies carbon anode was also set up to supply the primary consumable to the company.

Hap Seng Consolidated

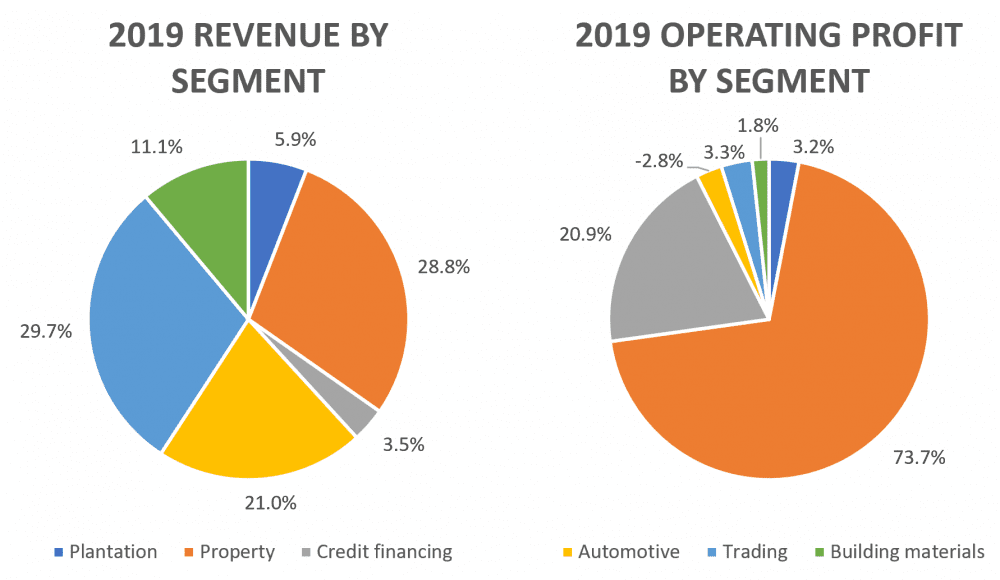

The group is a conglomerate with six core businesses, namely plantation, property investment and development, credit financing, automotive, trading, and building materials. It operates mainly in Malaysia and is present in Singapore, Indonesia, China, and the United Kingdom.

1. In 2019, its trading and property investment segments were the largest contributors of revenue and operating profit to the group respectively. The credit financing segment has the highest operating profit margin among the business segments. Between 2010 and 2019, the property and the credit financing segments of Hap Seng recorded a CAGR of 25.6% and 18.0% in its operating profits respectively.

2. The group’s revenue and net profit grew at a CAGR of low- to mid-tens. If we explore deeper, once extraordinary items are excluded, net profit dwindled by almost half between 2013 and 2019 because of a number of gains on disposal of subsidiaries and profit guarantee shortfall.

The surge in share price in the past 10 years was partly due to these extraordinary items. Once these items are excluded from the calculation, dividend payout ratio increase from 64.2% to 180.4% The group has been a consistent dividend payer in the past decade. However, it may need to increase its profit from operating activities in order to maintain its dividends per share in the future.

3. The property and the credit financing segments will likely drive growth for the group in the future. A number of property development projects were planned in the Klang Valley and Sabah. Gross non-performing loans ratio of the credit financing segment stood at 1.3% over the past eight years. The ratio is expected to rise in the short term as borrowers struggle to repay loans amid the economic hardship caused by COVID-19.

Hartalega

Hartalega is the largest nitrile glove manufacturer in the world that commands about 12% of the global glove market share. It manufactures and distributes primarily nitrile gloves. It can produce over 45,000 pieces of gloves per hour per production line.

1. In 2020, nitrile gloves accounted for 97% of Hartalega’s revenue. It is predominantly an original equipment manufacturing (OEM) glove manufacturer. More than 95% of its revenue in 2020 came from this segment while own-brand gloves made up the remaining 5% of revenue.

2. Certain people are sensitive to proteins found in natural rubber which makes natural rubber gloves less desirable for users (especially medical practitioners). As a result, Hartalega’s business continues to grow due to the switching momentum from natural rubber to nitrile gloves.

It also has a first-mover advantage compared to other glove players as it has been focusing on producing nitrile gloves since they were listed in 2008. Hartalega achieved impressive CAGR in its sales volume, revenue, and net profit relative to the organic growth of rubber glove consumption globally. Management shared in the 2020 AGM that the company is growing further amid the pandemic due to the structural step-up in the demand for gloves across medical and non-medical sectors.

| CAGR between 2010 and 2019 | |

|---|---|

| Hartalega’s glove sales volume | 22.6% |

| Hartalega’s revenue | 19.4% |

| Hartalega’s net profit | 13.7% |

| Global rubber glove consumption | 7.6% |

3. Hartalega has invested heavily in the research and development and the automated manufacturing of gloves. It manages to achieve economies of scale by maintaining the highest EBITDA and EBIT margins among its competitors.

| Company | Net Profit Margin* |

|---|---|

| Hartalega | 14.4% |

| Kossan Rubber | 7.0% |

| Top Glove | 6.6% |

| Comfort | 6.4% |

| Rubberex | 5.2%** |

| Supermax | 4.3% |

| Careplus | -2.0% |

*Based on latest audited financial year data. **Based on continuing operations only

Read more: 10 things to know about Hartalega before you invest (updated 2019)

The fifth perspective

These three stocks have greatly benefited from the bull run between 2010 and 2019. Past results may not be indicative of future performance. There is no guarantee that these stocks will become multi-baggers even if you invest in them now. However, if we do our homework and start investing now, there is still a chance of scooping up at least one or two multi-baggers in our portfolio in the near future.