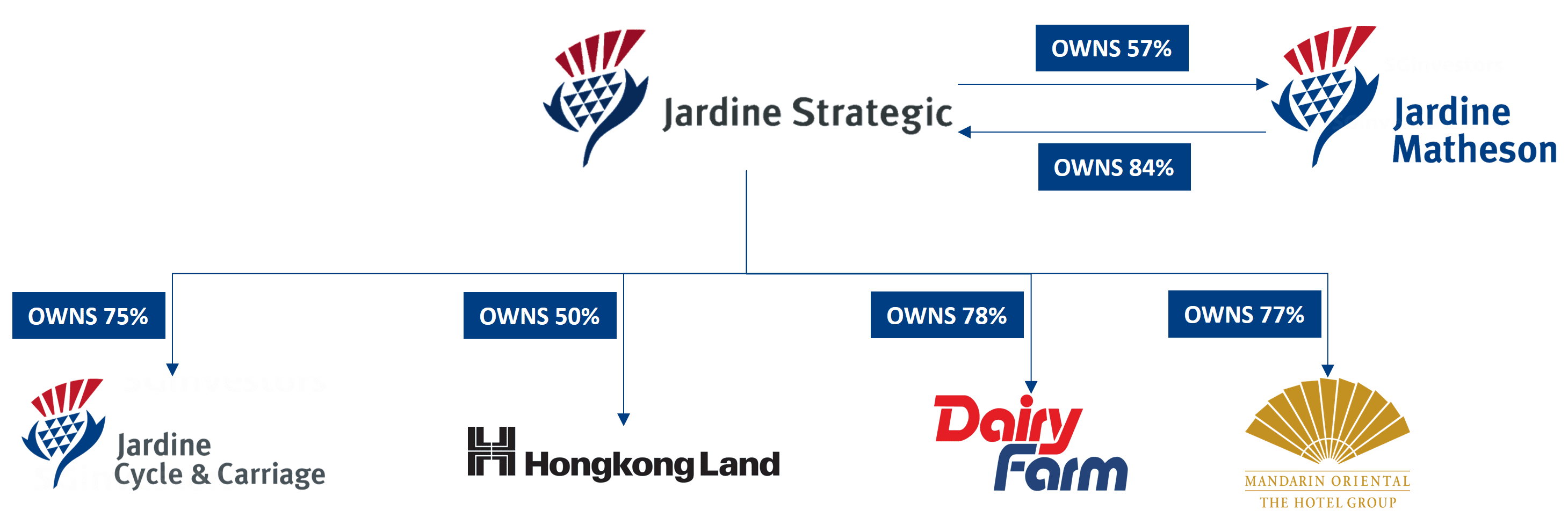

Jardine Strategic Holdings Limited (SGX: J37) is a Singapore-listed conglomerate with multiple business interests located across the Asia-Pacific. Presently, it owns and derives income from the following public-listed subsidiaries:

- 57% shareholding of Jardine Matheson Holdings (SGX: J36)

- 75% shareholding of Jardine Cycle & Carriage (SGX: C07)

- 50% shareholding of Hongkong Land (SGX: H78)

- 78% shareholding of Dairy Farm International (SGX: D01)

- 77% shareholding of Mandarin Oriental International (SGX: M04)

Jardine Strategic is among the top 30 constituents of the Straits Times Index (STI) and is worth around US$24.6 billion in market capitalization as I write. In this article, I’ll bring a detailed account of the performances of each of its main subsidiaries, discuss the challenges it faces, and provide an update on its recent developments.

As such, here are 11 things you need to know about Jardine Strategic before you invest:

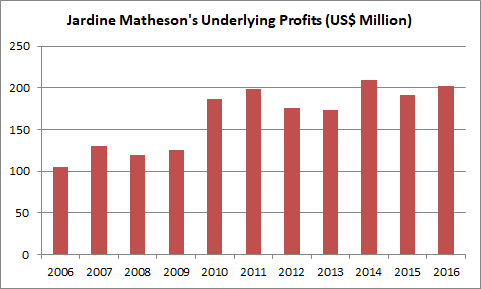

1. Jardine Matheson is also a huge conglomerate and is ranked among the top 30 constituents of the STI. It owns a portfolio of businesses in engineering, construction, automobile dealerships, and insurance services under Jardine Pacific, Jardine Motors, and Jardine Lloyd Thompson respectively. In addition, Jardine Matheson owns 84% shareholdings in Jardine Strategic, thus, deriving income from all of Jardine Strategic’s subsidiaries mentioned above. Overall, excluding profits from Jardine Strategic, Jardine Matheson has contributed an increase in underlying profits, up from US$105 million in 2006 to US$202 million in 2016.

Source: Annual reports of Jardine Strategic

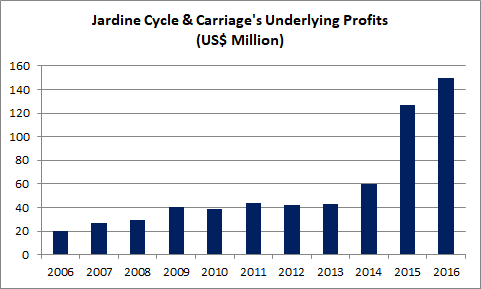

2. Jardine Cycle & Carriage is a conglomerate which owns a portfolio of automobile companies across Southeast Asia. Currently, it owns 50.1% of Indonesian-listed Astra International, an established conglomerate in Indonesia. Jardine C&C also operates a network of automotive dealerships in Vietnam, Malaysia, Singapore and Indonesia. In 2015, Jardine Cycle & Carriage increased its stake in Truong Hai Auto Corporation from 19% to 22%, and acquired a 25% stake in Thai-listed Siam City Cement for US$615 million. The inclusion of these two associate companies have resulted in substantial growth in underlying profits to Jardine Strategic in 2015 and 2016.

Source: Annual reports of Jardine Strategic

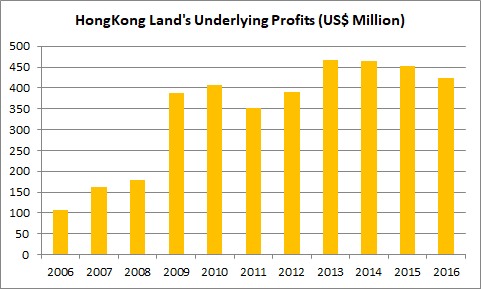

3. Hongkong Land is a leading property development and investment group with strategic assets located mainly in China, Hong Kong, and Singapore. Hongkong Land has seen a gradual increase in rental income from its investment properties and has substantially grown its sales from development projects in Chongqing, China. As a result, Jardine Strategic has received higher underlying profits from Hongkong Land, up from US$107 million in 2006 to US$424 million in 2016.

Source: Annual reports of Jardine Strategic

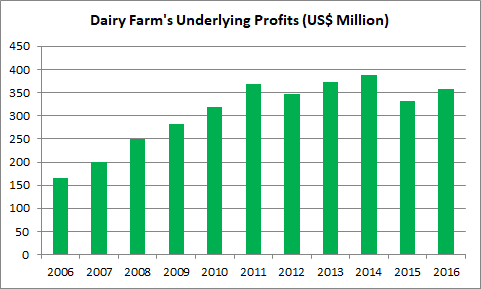

4. Dairy Farm International is a leading retail conglomerate with a brand portfolio incluing Wellcome, Giant, Cold Storage, 7-Eleven, Guardian, Mannings, Rose Pharmacy, and IKEA. It also owns 50% of Maxim’s, a leading caterer and an operator of a network of restaurants, cafes, and bakeries in Hong Kong. Dairy Farm remains one of Jardine Strategic’s main income contributors as it has contributed US$300-400 million in underlying profits annually since 2010.

Source: Annual reports of Jardine Strategic

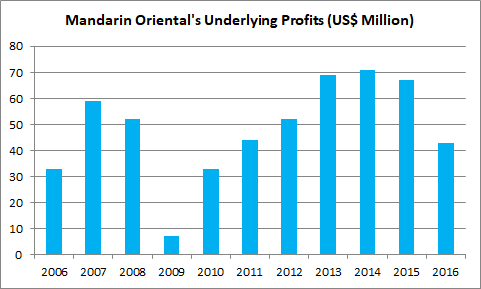

5. Mandarin Oriental International is a multinational hotel investment and management group. It operates 30 hotels and eight residences in 20 countries. Despite its size of operations, Mandarin Oriental remains a smaller income contributor to Jardine Strategic. It has brought, on average, US$60 million in underlying profits annually to Jardine Strategic over the last five years.

Source: Annual reports of Jardine Strategic

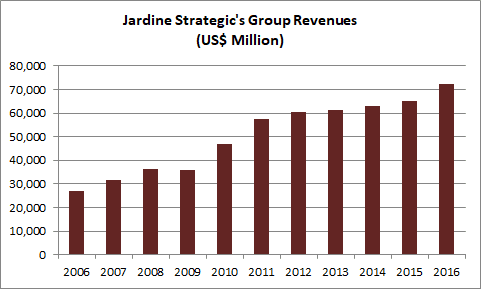

6. Overall, Jardine Strategic has achieved a CAGR of 10.3% in group revenues over the last 10 years, up from US$27.1 billion in 2006 to US$72.4 billion in 2016. Group revenue is inclusive of 100% of sales recorded by Jardine Matheson, and all associates and joint ventures of Jardine Strategic. The sales growth is due to growth in revenues from Hongkong Land, Dairy Farm, and Jardine Cycle & Carriage during the period.

Source: Annual reports of Jardine Strategic

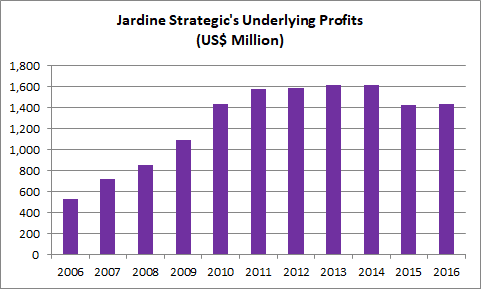

7. Jardine Strategic increased its underlying profits from US$526 million in 2006 to US$1.62 billion in 2013, before recording a string of declines to US$1.44 billion in 2016. The profit decline is mainly due to lower profits recorded by Astra International since 2013.

Source: Annual reports of Jardine Strategic

8. From 2007 to 2016, Jardine Strategic generated US$21.4 billion in cash flows from operations. It received US$4.9 billion in dividends from its investments in associate and joint venture companies and another US$1.2 billion in interest income. It has also raised US$3.8 billion in net long-term debt over the same period. Out of which, Jardine Strategic has spent:

- US$9.0 billion in net capital expenditures

- US$876.0 million in net acquisitions of subsidiaries

- US$3.9 billion in net acquisitions of associates and joint venture companies

- US$1.7 billion in net acquisitions of investment properties

- US$1.7 billion in dividend payments to shareholders

Overall, Jardine Strategic has increased its cash reserves from US$1.3 billion in 2006 to US$5.24 billion in July 2017. Its debt-to-equity ratio is 0.15. Jardine Strategic has used a combination of positive cash flows from operations, dividend and interest income, and long-term debt to expand its business empire and reward its shareholders with dividends.

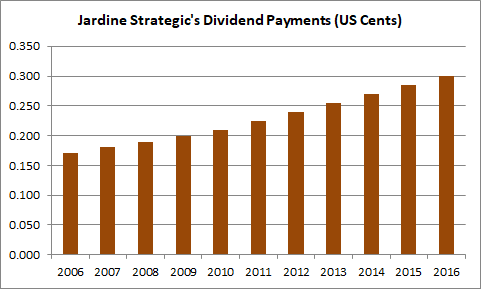

9. Jardine Strategic has achieved a CAGR of 5.8% in dividend per share over the last 10 years, up from 17.0 cents in 2006 to 30.0 cents in 2016. As at 14 December 2017, Jardine Strategic is trading at US$39.99 a share. If Jardine Strategic is able to maintain its dividend per share at 30.0 cents, its expected dividend yields is 0.7%.

Source: Annual reports of Jardine Strategic

10. Invariably, Jardine Strategic is exposed to the risks associated with multiple industries including mainly property, hospitality, automobile and retail. Negative developments in any of these industries where Jardine Strategic has a presence in the Asia-Pacific may adversely affect its financial performances. On the flip side, a strong performance from one of its subsidiaries may offset any potential weakness from another of its subsidiaries. After all, Jardine Strategic is an multinational multi-industry conglomerate.

11. In 2017, Jardine Strategic has continued to enlarge its conglomerate through multiple strategic acquisitions made by its individual subsidiaries. Its recent developments include:

- In 2017, Jardine Strategic increased its stake in ZhongSheng Group Holdings Limited to 20%. Listed in Hong Kong, ZhongSheng is one of the leading automobile dealership groups in China, representing a brand portfolio comprising Mercedes Benz, Lexus, Audi, Porsche, Land Rover, Toyota, Nissan, Volkswagen, Chrysler, and Honda.

- In June 2017, Jardine Strategic acquired a 22% stake in Greatview Aseptic Packaging Company Limited. Listed in Hong Kong, Greatview is presently the second largest supplier of aseptic carton packaging in China and the third largest globally.

- In June 2017, Hongkong Land jointly announced with IOI Properties to develop 1.1 hectares of Central Boulevard Land in Singapore. Hongkong Land owns 33% of the joint venture. This will be in addition to Jardine Strategiec’s existing portfolio of 450,000 square metres of prime property in Hong Kong, 165,000 square metres of office property in Singapore, and a 50% interest in a leading office complex in Jakarta.

- In August 2017, Dairy Farm acquired the remaining 34% stake in Rustan’s and now fully owns a leading operator of supermarkets & hypermarkets in the Philippines. As at 30 June 2017, Dairy Farm has enlarged its retail network, including associates and joint venture companies, to 6,600 outlets overall.

- In the first half of 2017, Mandarin Oriental announced four new management contracts. New hotels are scheduled to open in Dubai and Honolulu in 2020, and in Melbourne in 2023. In additiona, the group has taken over a hotel in Santiago, Chile. The hotel is to be rebranded as Mandarin Oriental.

- In the first half of 2017, Astra International completed the 100% acquisition of PT Baskhara Utama Sedaya which owns a 45% stake in the 116-kilometre Cikopo-Palimanan toll toad for 5 trillion rupiah.

- United Tractors, a 60%-owned subsidiary of Astra International, owns a 25% stake in Bhumi Jati Power. It is a joint venture between Sumitomo Power Corporation and Kansai Electric Power which plans to develop and operate two 1,000MW thermal power plants in Central Java, Indonesia. Costing around US$4.2 billion, this project is expected to start commercial operations in 2021.

The fifth perspective

Over the last 10 years, Jardine Strategic has grown from strength to strength through organic growth and strategic acquisitions of market leaders across the Asia-Pacific. This has contributed to growth in group revenues and dividend payments to shareholders. Moving forward, it is vital for Jardine Strategic to maintain a healthy balance sheet as it continues to build its business empire and ensure its dominance in its industries in the years ahead.