Frasers Centrepoint Trust (FCT) is a Singapore REIT that currently owns a portfolio of six suburban malls located in Singapore. On 3 September 2020, FCT announced its intention to acquire the remaining 63.1% stake in AsiaRetail Fund (ARF) for $S1.06 billion. The acquisition will add five Singapore suburban malls – Tiong Bahru Plaza, Hougang Mall, White Sands, Tampines 1, and Century Square – and one Singapore office property, Central Plaza.

The deal was approved by FCT unitholders at an extraordinary general meeting where CEO Richard Ng gave a presentation highlighting the benefits of the acquisition despite the backdrop of COVID-19. Will Singapore malls continue to thrive despite the impact of the pandemic and e-commerce?

Here are five things I learned from the 2020 Frasers Centrepoint Trust EGM.

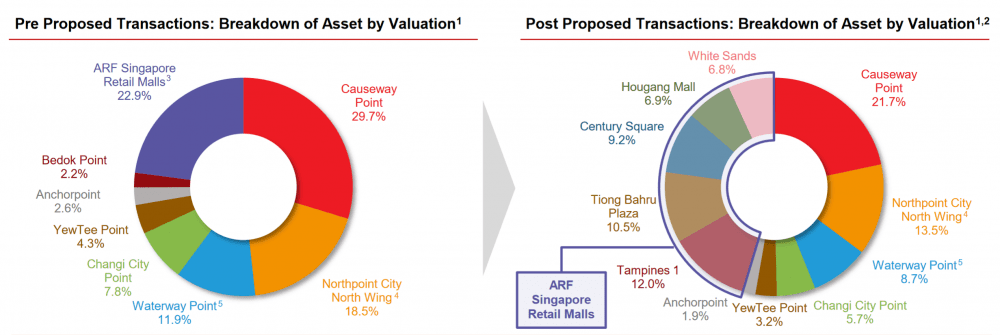

1. Post-acquisition, FCT will become the eighth largest Singapore REIT by market capitalization, and the second largest owner of retail space in Singapore. FCT’s portfolio value will grow from S$4.0 billion to S$6.7 billion. The enlarged portfolio will reduce concentration risk – the asset value of FCT’s top five properties will decrease from 72.2% to 52.8%.

However, FCT’s gearing ratio will increase from 35.0% to 39.3%. While this is still comfortably below the 50% regulatory limit for Singapore REITs, it is far higher than FCT’s historical gearing. In the last 10 years, FCT’s gearing ratio has typically hovered around 30%.

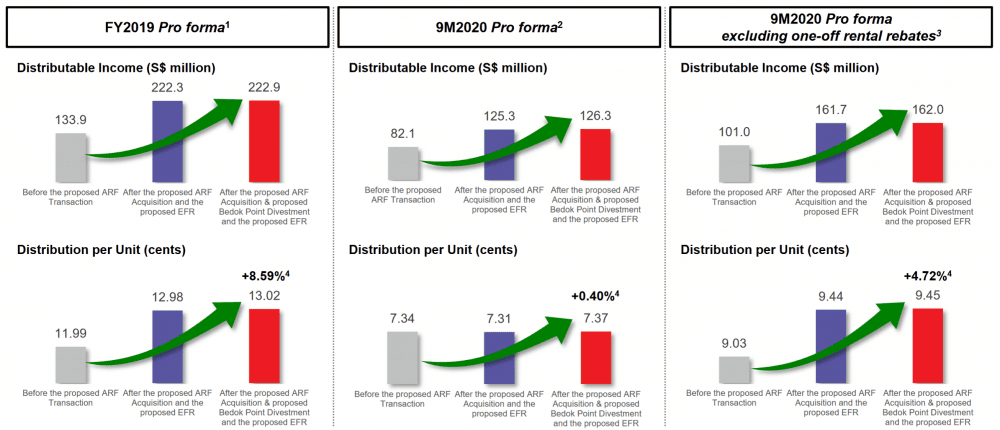

2. The acquisition is expected to be DPU-accretive for unitholders. Based on FY2019 pro forma figures, distribution per unit (DPU) will increase 8.6% from 11.99 cents to 13.02 cents. However due to the impact of COVID-19 this year, DPU will grow 4.7% post-acquisition based on 9M 2020 pro forma figures (excluding one-off rental rebates).

However, I do expect the effects of COVID-19 to diminish over time (we’re already seeing signs of recovery) and the ARF acquisition to greatly benefit unitholders over the long term.

3. FCT will divest Bedok Point to its sponsor, Frasers Property, for S$108.0 million to fund part of the acquisition. Some unitholders questioned the sale of the property as it was originally purchased for S$129.1 million in 2011. However, Bedok Point has been a laggard in FCT’s portfolio for a number of years now, especially since the opening of Bedok Mall in 2013 (owned by CapitaLand Mall Trust).

The poor performance of Bedok Point had been highlighted at the FCT AGMs we attended in 2017, 2018, and 2019, and the board have always been candid about divesting the property if a suitable offer came along. The mall’s small size and farther distance to Bedok MRT limits its competitiveness in the area and its sale will allow FCT to reinvest the capital in higher-yielding assets.

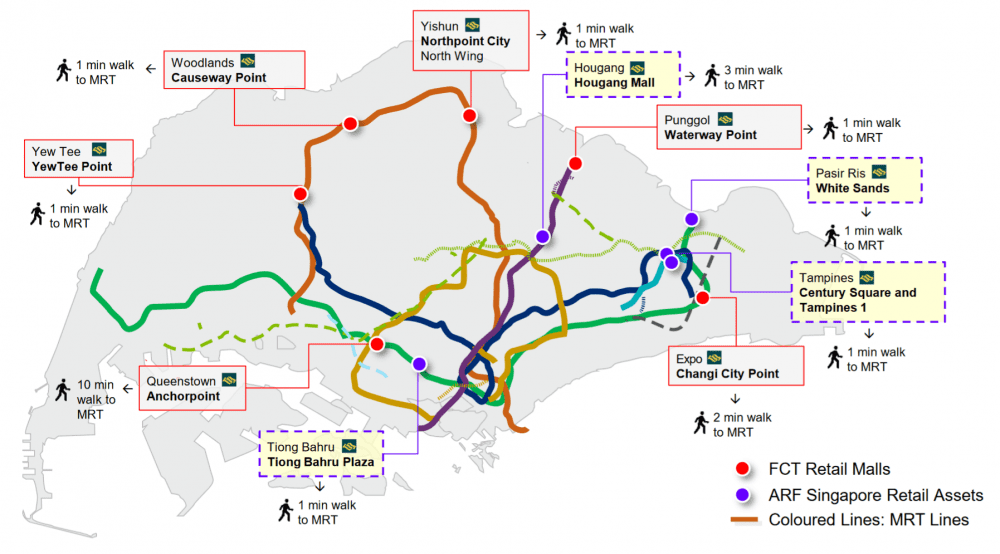

4. FCT intends to remain focused on Singapore suburban malls. Despite the pandemic, well-located suburban malls remain an integral hub for daily commutes, and for locals to shop for essential goods and services. Except for Anchorpoint, all of FCT’s and ARF’s malls are located next to MRT stations.

Post-acquisition, FCT will serve a catchment population of 3.0 million people in in the suburbs, a 40% increase from 2.1 million currently. The suburban population is also expected to grow as the Singapore government continues to grow and develop regional population centres.

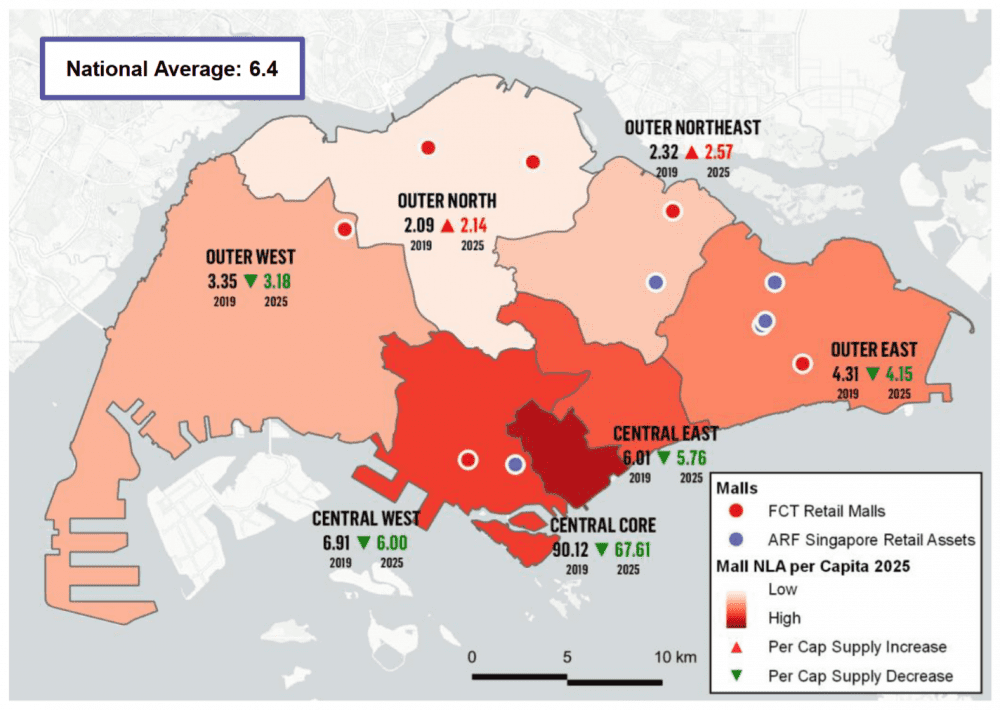

Singapore also has lower retail floorspace per capita (6.4 square feet) compared to the U.S. (23.1), Hong Kong (10.1), and Kuala Lumpur (9.9). However, the number is a national average and retail floorspace supply is markedly less in suburban areas in Singapore.

Singapore retail floorspace supply will remain tight over the next five years and is projected to grow to only 6.5 square feet per capita by 2025.

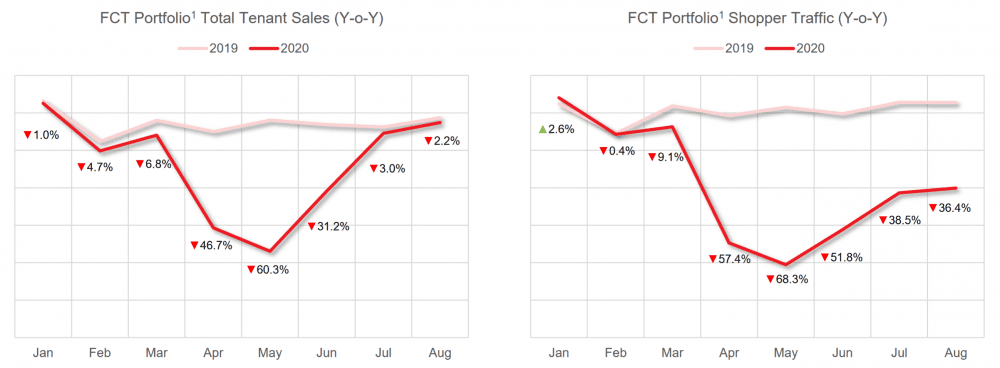

5. Singapore retail looks like it’s rebounding strongly post-pandemic. The lockdown significantly impacted FCT malls during the peak COVID months where shopper traffic fell 68.3% year-on-year in May. Since then, shopper traffic has recovered but is still down 36.4% year-on-year in August.

However, despite the lower shopper traffic, FCT’s tenant sales have virtually recovered to pre-pandemic levels, falling just 2.2% year-on-year in August. Shopper traffic will remain depressed in the interim due to Phase 2 measures limiting shopper density in malls. But we can cautiously expect shopper traffic to increase when Singapore enters Phase 3.

The fifth perspective

Besides Central Plaza, FCT’s portfolio post-acquisition will comprise 11 suburban malls all located within Singapore. FCT’s Singapore-centric focus means that it will remain as the only ‘pure play’ Singapore retail REIT once CapitaLand Mall Trust merges with CapitaLand Commercial Trust. Other similar Singapore-listed retail REITs – like Mapletree Commercial Trust, Starhill Global REIT, and SPH REIT – own relatively more diversified portfolios which include office and/or overseas assets.

We recently conducted a roundtable discussion on whether Singapore retail REITs can survive or even thrive in a post-COVID world, and how malls have to evolve to meet the threat of e-commerce. Find out which Singapore retail REITs are most likely to perform post-pandemic. You can watch the roundtable here.

Liked our analysis of this EGM? Click here to view a complete list of AGMs and EGMs we’ve attended »

Hi, understand that they are raising fund through private placement, what is the impact to existing unit holder?

There will be a slight dilution in terms of unit ownership, but the increased cash flow from the new properties means that the acquisition is still expected to grow your distribution per unit.