Back in June, Temasek’s wholly-owned subsidiary, Azalea Group, offered the Astrea IV bond to retail investors in Singapore. The bond was the first ever private equity backed-bond to be listed here.

This week, Temasek once again broke new ground with the T2023-S$ bond offer — it is the very first time that Temasek bonds are open to retail investors in Singapore, which was previously available only to institutions and accredited investors.

For those who don’t already know, Temasek Holdings is a private investment company fully-owned by the Singapore government that manages a portfolio of assets worth S$308 billion (as at 31 March 2018). It manages one of the largest funds in the world — ninth largest according to this list — and many of the biggest companies listed in Singapore like DBS Group, Singapore Airlines, Singtel, and CapitaLand are partly-owned by Temasek.

So when Temasek launches its first-ever public retail bond, investors sit up and take notice. But should you invest in the T2023-S$ Temasek retail bond?

Here are five things you need to know before you invest:

1. Returns are guaranteed by Temasek

The T2023-S$ Temasek retail bond is a five-year bond that pays a fixed interest of 2.7% per annum. Interest payments are made every six months and the bond will mature on 25 October 2023.

This basically means for every S$10,000 invested, you will receive fixed payments of S$135 every six months and receive your full principal back at the end of five years. Your principal and interest payments are guaranteed by Temasek. (We’ll discuss why Temasek is able to guarantee your returns below.) The minimum to invest for the retail investor is S$1,000, and upwards in multiples of S$1,000.

A total of S$400 million of bonds will be offered – half of which is open for retail investors. Temasek has the option to increase the bond offer size to S$500 million if it is oversubscribed. According to the private briefing I attended, the S$100 million ‘upsize’ may be offered to either retail or institutional/accredited investors depending on the oversubscription.

2. Returns comparable to SSB and CPF

At 2.7% per annum, the T2023-S$ Temasek retail bond returns higher than your CPF Ordinary Account (2.5%) and the Singapore Savings Bond (SSB) over the same period (2.22%).

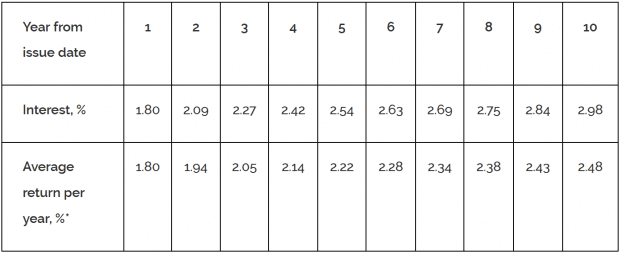

Moreover, the SSB pays a graduated interest rate — instead of a fixed one — that only rises the longer you hold onto it. This means if you redeem your SSB at an earlier date, you would have earned a lower average interest rate:

SSB NOV18 interest rates. Source: Singapore Savings Bond

The Temasek retail bond interest rate is also easily higher than the local bank’s fixed deposit rate — DBS’s five-year rate is just 1.35%.

If you plan to park your money somewhere for five years, the Temasek retail bond is an option you can seriously consider.

3. Extremely low risk of default

Bonds are usually considered less risky than stocks but that doesn’t mean there is no risk. A company can default on interest payments and principal repayments, leaving investors in the lurch. The Ezra bond default is just one recent example, which is why credit quality is a key consideration for bond investors.

There are two key areas to evaluate: the company’s ability to 1) service its interest payments and 2) repay its debts.

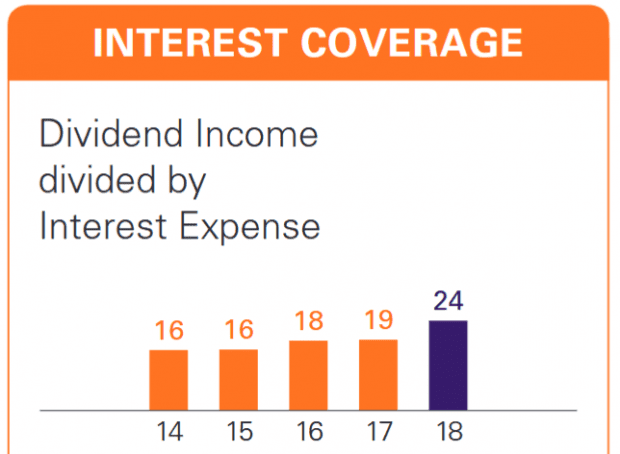

For Temasek, its dividend income to interest payments ratio is 24 times. This basically means Temasek earns 24 times in annual dividend income what it has to pay in interest every year.

Source: Temasek Holdings

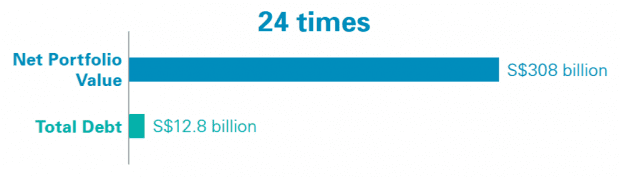

Temasek’s net portfolio value of S$308 billion is also coincidentally 24 times its total debt of S$12.8 billion. Temasek’s liquid assets alone are nine times its total debt. In other words, Temasek has very little debt compared to the size of its assets.

Source: Temasek Holdings

Looking at the figures, it’s reasonable to understand why Temasek is able to guarantee the interest payments and principal repayment of the T2023-S$ bond; the S$400 million on offer is a relatively small amount compared to its total debt and assets.

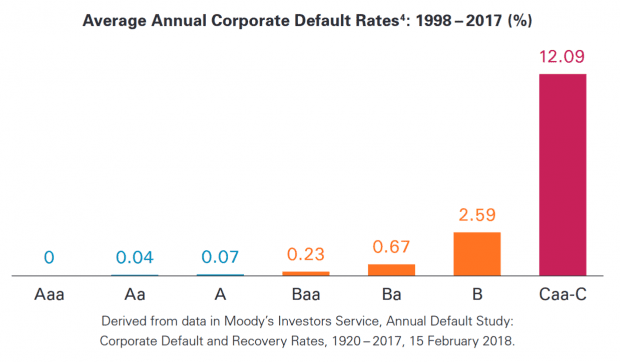

Temasek is rated AAA/Aaa by S&P Global Ratings and Moody’s Investors Service respectively, and the T2023-S$ bond is rated likewise. Historically, issuers rated Aaa have had zero defaults in the last 20 years from 1998 to 2017.

4. However, interest rates are rising…

So far, everything looks pretty good – your returns are guaranteed, and the risk of default is negligible. But you can still potentially lose money investing in the Temasek retail bond. How so?

Because of rising interest rates.

When interest rates rise, bond prices fall (and vice versa). As a simple example, if an investor buys a $1,000-bond with a fixed interest rate of 5%, his annual interest earned is $50. But if interest rates rise to 10%, investors now only need to invest $500 to earn the same interest of $50. Therefore, the value of the bond falls.

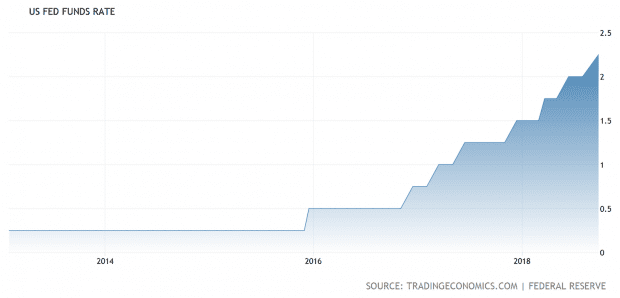

As we know, the U.S. Federal Reserve has been steadily raising interest rates. We had three interest rate hikes in 2017, and three hikes so far this year.

The Fed forecasts one more rate hike in December, three more in 2019, and one more in 2020. So expect interest rates to rise for the foreseeable future.

Now, this doesn’t matter if you plan to hold onto your Temasek retail bond until maturity. In that scenario, you will receive your guaranteed payments and principal at the end of five years. But if you decide to sell your bond on the open market before it matures, then you may suffer a loss on the face value of the bond if interest rates have risen.

5. You can use your CPF to invest

The T2023-S$ Temasek bond is eligible for purchase under the CPF Investment Scheme. This means you can use up to 35% of your investible savings in your CPF Ordinary Account (OA) to purchase the bond during the public offer, or on the open market when it lists on the SGX.

Since the CPF OA earns you 2.5% interest and the Temasek bond earns you 2.7%, it’s quite obvious you can use your CPF funds to invest in the bond to earn the extra 0.2% interest per year. Twenty basis points may not seem like much but since your money is ‘stuck’ in CPF, why not make that extra anyway? (The alternative here is to transfer your CPF Ordinary Account to your CPF Special Account which earns 4% interest per annum, but that is a one-way trip.)

Of course, this assumes that you don’t plan to sell the bond before maturity where you could face a potential loss in face value, or use the money in your OA for your housing needs in the next five years.

(If you haven’t already opened your CPF Investment Account and would like to know how, you can follow the steps here.)

The fifth perspective

If you’re looking to invest in a AAA-rated bond with guaranteed returns on a medium five-year term, then the T2023-S$ Temasek retail bond should check all your boxes. At the same time, it’s important that you’re aware you could make a potential loss if interest rates rise and you sell the bond before maturity.

The T2023-S$ bond offer is open from now until Tuesday, 23 Oct 2018, 12:00 p.m. The bond will be issued on Thursday before it starts trading on the SGX on Friday, 26 October 2018.

You can apply for the bond via ATM or internet/mobile banking, and it’s important you find out more and read the offer documents before making a decision to invest.

In some ways I still prefer the SSB over this Temasek Bond. My reasons are as follows:

1. My understanding is that the SSB can be withdrawn without penalty, and you even get to receive the interest and full principal returned.

2. The secondary market for bonds in Singapore is a bit uncertain. In the US and UK you can make a capital gain on selling some government T-bills (US) or “Gilts” (UK) if the prevailing interest rates are lower than that paid by the security in question. There does not appear to be a similar secondary market in Singapore (please correct me if I’m wrong on this point).

However, on the positive side these are only a 5-year bond. So the current yield differential compared to the SSB at the moment (over 5-years) is actually just over 0.5% better than the SSB held for the same period. It’s still likely to be a much better deal than a fixed deposit at one of the banks.

Hey Jonathan,

Thanks for sharing as always!

Regarding Point 2, there is a public/secondary market for bonds on the SGX but retail exposure for bonds in Singapore is very small. Right now, there are only 13 bonds listed.

This is one of the reasons why Temasek is offering the T2023-S$ bond with a retail tranche. It wants to engage retail investors in Singapore and, at the same time, broaden its stakeholder base. Hopefully, this may develop the retail market for bonds in Singapore, so we’ll see what happens down the line.

How do you buy this bond with your cpf?

Hi Ivan,

You can apply for the Temasek bond via ATM or internet/mobile banking. There’s an option where you can select ‘CPF’ to purchase the bond.

I felt that this Temasek bond is not compelling enough for me to dive in. My reasons are as follows:

You have rightly stated that there is a strong possibility of another interest rate hike in Dec 2018 and another 3 more in 2019. Based on historical record that each hike is 25 basis points or quarter % and till end 2019, a total of 4 hikes in place. This is 1 full% or 100 basis points. Add this 1% to the current rate of 2-2.5%, it will surpass the 2.7% that this bond is giving.

In a fast rising rates, it is wise not to commit funds longer than a one year let alone a lock-in of 5 years tenor for this bond.

Yes, that’s a good point. It really depends on the individual’s investment objectives whether the Temasek bond and return is suitable for them or not.

Quote

“Since the CPF OA earns you 2.5% interest and the Temasek bond earns you 2.7%, it’s quite obvious you can use your CPF funds to invest in the bond to earn the extra 0.2% interest per year.”

Would like to clarify if this is true, as 2.5 % interest of CPF OA is compounded, while Temasek bond is not.

Therefore, after 5 years, the extra interest is not 0.2% per year but much lesser?

Good point.

I did some quick math:

For every $10,000 invested, the Temasek bond at 2.7% simple interest p.a. for five years will net you $11,350.00.

The CPF OA at 2.5% compounded p.a. for five years will net you $11,314.08. Effectively, the CPF’s OA 2.5% compound interest over five years is 2.628% in simple interest.

So the Temasek bond still earns you more. But you could say that since the gain is negligible, you can choose to leave it in the CPF.

Hi Adam,

What will be the real rate of returns if CPF is used to buy the bonds after bank and other yearly administrative charges are incurred by Temasek/banks?

Hi Nick,

The banks charge a maximum fee of S$25 per transaction. So it really depends on the value of the bond you’re allotted. The larger your investment, the lower your costs percentage-wise.

https://www.cpf.gov.sg/Assets/members/Documents/INV_Annexd.pdf

Agreed