A year ago, Phillip Capital Management, along with Lion Global Investors, launched the Lion-Phillip S-REIT ETF. The ETF aimed to give investors a way to invest in a diversified basket of Singapore REITs (S-REITs) which paid a steady stream of distributions. (At the moment, the average distribution yield for S-REITs is 6.8%.)

The ETF was met with a largely positive response from the market – Lion Global Investors and Phillip Capital Management initially aimed to raise S$40-50 million but exceeded their target when the fund raised over S$100 million last October.

Capitalizing on the Singapore market’s appetite for yield, Phillip Capital Management has now launched the Phillip SING Income ETF. The initial offer period for the ETF will close at 11:00 a.m. on 19 October 2018 before its lists on the Mainboard of the SGX on 29 October 2018.

One problem with chasing high-yield stocks is that it can turn out to be a classic ‘dividend trap’. Yields are high only because the share price has fallen due to business distress. And eventually the company has to cut or suspend its dividend because of its deteriorating fundamentals.

To avoid the so-called dividend trap, the Phillip SING Income ETF aims to track the Morningstar Singapore Yield Focus Index which uses a quantitative, rules-based methodology to select the top 30 stocks listed on the SGX that are able to pay a sustainable and growing dividend.

So does the methodology work? Here are five things to know before you invest in the Phillip SING Income ETF.

1. More defensive than the STI

According to the Morningstar Singapore Yield Focus Index, these are the top 30 high-quality, dividend stocks listed in Singapore:

| Index Constituents | Portfolio Weight |

|---|---|

| Singapore Telecommunications | 10.2% |

| DBS Group | 8.5% |

| OCBC Bank | 7.9% |

| UOB Bank | 7.5% |

| Singapore Exchange | 5.8% |

| ST Engineering | 5.2% |

| SATS | 5.1% |

| CapitaLand Commercial Trust | 5.4% |

| Hongkong Land | 4.7% |

| CapitaLand Mall Trust | 5.2% |

| Mapletree Commercial Trust | 4.7% |

| Netlink NBN Trust | 4.1% |

| Dairy Farm International | 3.5% |

| Parkway Life REIT | 2.3% |

| SIA Engineering | 2.2% |

| Sheng Siong Group | 2.1% |

| M1 | 1.6% |

| Manulife US REIT | 1.6% |

| Keppel Infrastructure Trust | 1.6% |

| OUE Hospitality Trust | 1.5% |

| United Engineers | 1.4% |

| Haw Par Corp | 1.4% |

| StarHub | 1.2% |

| First REIT | 1.0% |

| AIMS AMP Capital Industrial REIT | 0.9% |

| Hong Leong Finance | 0.9% |

| SPH REIT | 0.9% |

| Raffles Medical Group | 0.8% |

| Frasers Hospitality Trust | 0.5% |

| Silverlake Axis Trust | 0.4% |

Source: Phillip Capital Management, Bloomberg

The maximum weight per security is 10% and the index is rebalanced every six months.

As you can see, you’ll notice many familiar names – some of which you can also find on the Straits Times Index (STI) — including the three local banks, DBS, OCBC, and UOB; telcos like Singtel and StarHub; and some of the larger companies in Singapore like ST Engineering and SGX. Dairy Farm International, which recently replaced StarHub in the STI, is also included.

However, unlike the STI which simply weighs its constituents based on their market caps, the Singapore Yield Focus Index selects and weighs its components according to their composite factor scores which comprises the quantitative moat score, financial health factor, and trailing 12-month dividend yield.

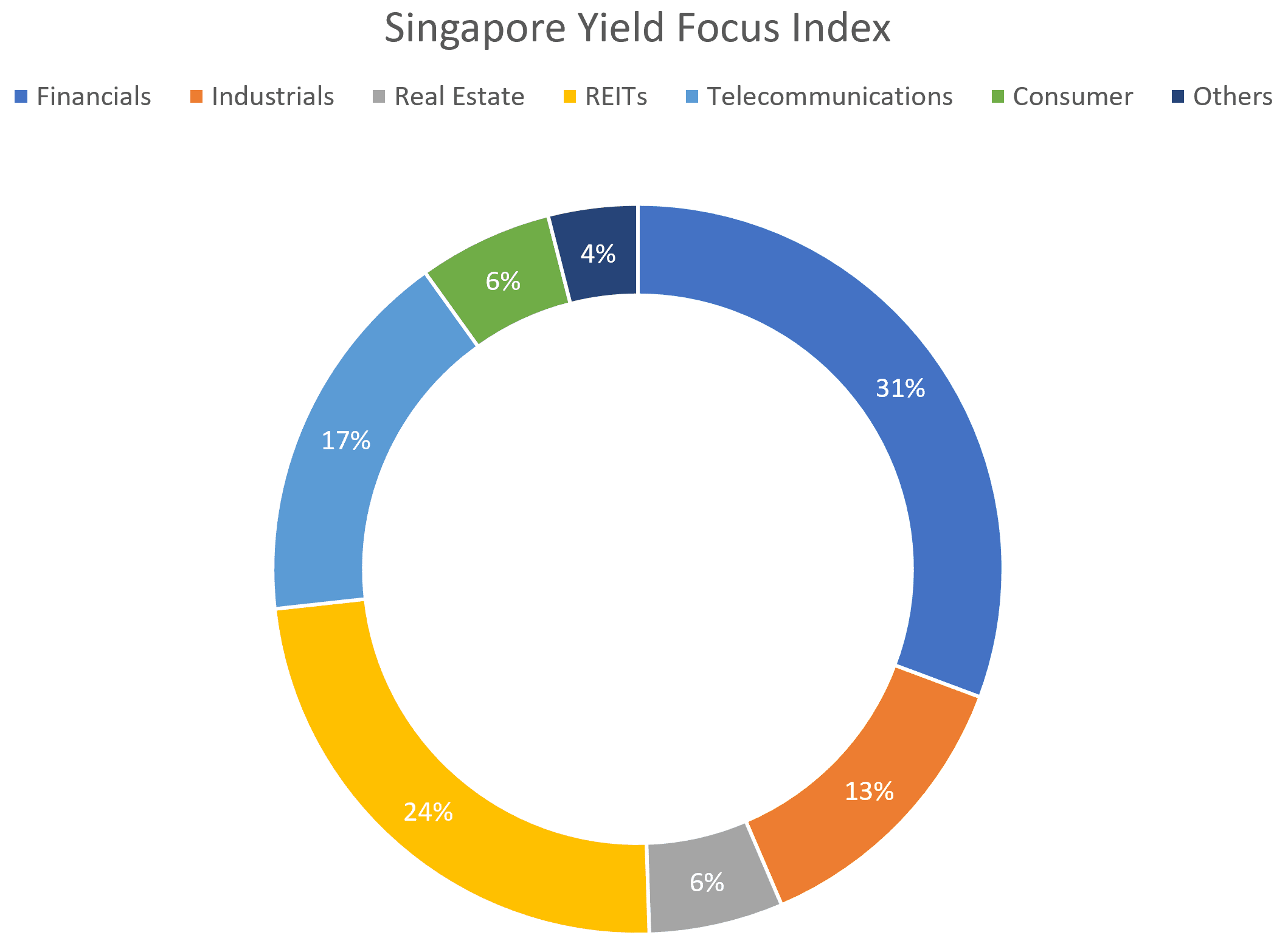

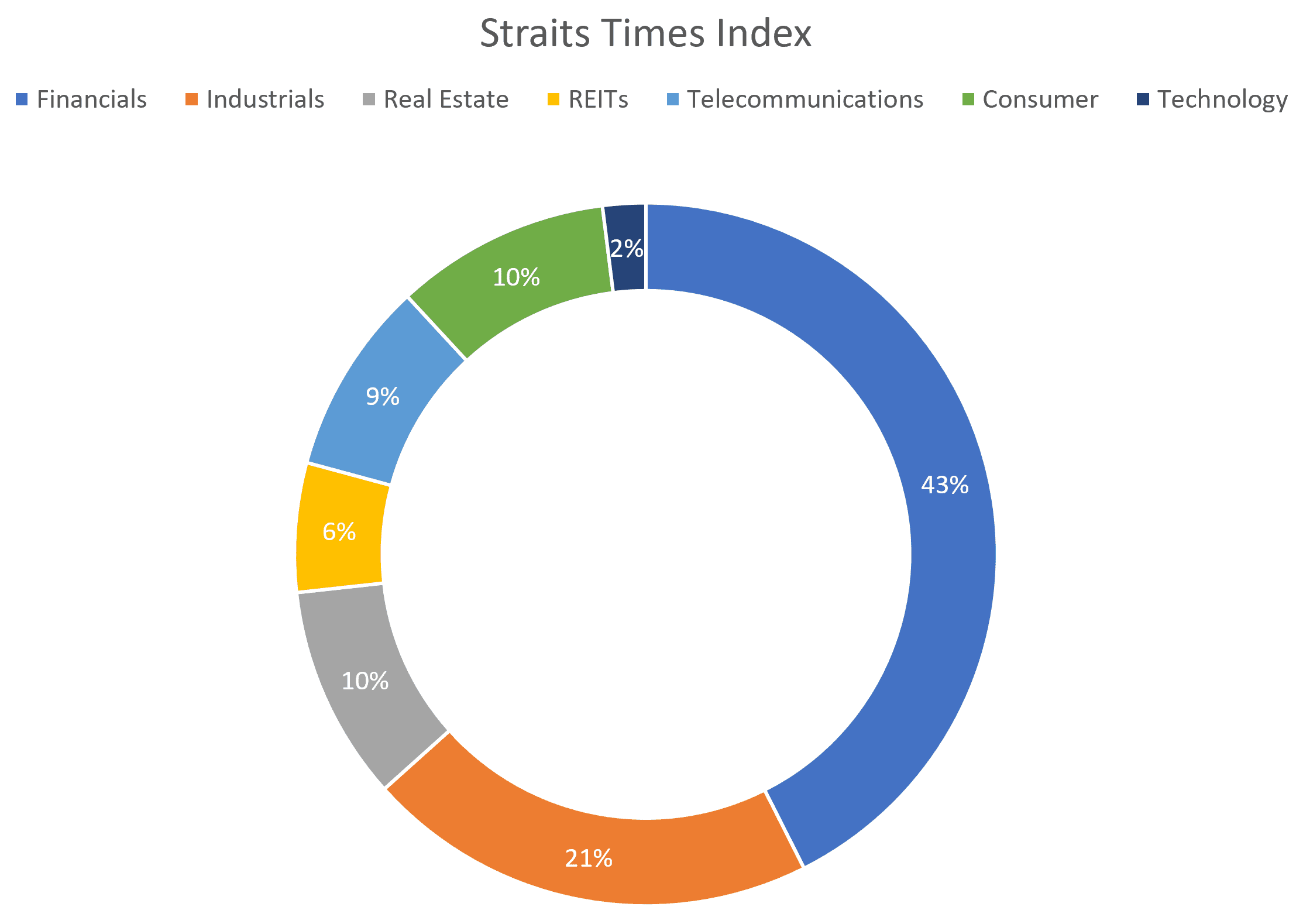

This is why, compared to the STI, the Singapore Yield Focus Index is more heavily weighted in the REIT (24%) and telecommunications (17%) sectors which tend to be more defensive and pay steady dividends.

Source: Phillip Capital Management, Bloomberg

Source: Phillip Capital Management, Bloomberg

You also see stocks like Sheng Siong Group, Raffles Medical Group, and Silverlake Axis which are too small to be listed on the STI, but are included on the Singapore Yield Focus Index due to their stable dividends.

Do also note that M1 is currently the subject of a privatization offer. If the offer is accepted, M1 will be delisted and replaced in the ETF.

2. Higher returns, but more expensive

| Cumulative Return (2005-2018) | Annualised Return (2005-2018) | Dividend Yield | P/E | |

|---|---|---|---|---|

| Morningstar Singapore Yield Focus Index | 234.4% | 9.6% | 5.01% | 16.3 |

| Straits Times Index | 113.7% | 5.9% | 3.47% | 11.1 |

| MSCI Singapore | 130.3% | 6.5% | 4.69% | 13.1 |

Source: Phillip Capital Management, Bloomberg

From 2005 to 31 August 2018, the Singapore Yield Focus Index had a cumulative return of 234.4% (inclusive of dividends), compared to the STI which cumulatively returned 113.7%.

The Singapore Yield Focus Index’s trailing 12-month dividend yield is 5.0% — higher than the STI’s yield of 3.47% (as of 5 Oct 2018). This is expected as the Singapore Yield Focus Index is supposed to be weighted towards higher yields anyway.

Looking from a valuation perspective, the Singapore Yield Focus Index is more expensive with a price/earnings ratio of 16.3 (as at 31 August 2018). In comparison, the STI’s P/E ratio is currently at 11.1.

3. No tax transparency (for now)

Distributions from S-REITs are tax-free for investors. From 1 July 2018, this tax transparency treatment was also extended to ETFs invested in S-REITs. Previously, distributions from S-REITs to ETFs were taxed at 17%, which made investing in S-REIT ETFs tax inefficient. However, this treatment only applies to ETFs that invest entirely in REITs (like the Lion-Phillip S-REIT ETF). The Phillip SING Income doesn’t qualify for tax transparency as it invests in other securities besides REITs.

Phillip Capital Management plans to speak to the authorities about extending the tax transparency treatment to any ETF that invests in REITs, but for now the dividend yield for the Phillip SING Income ETF is effectively 4.8% after factoring the 17% withholding tax on S-REIT distributions.

4. Tracking error

When it comes to investing in an ETF that tracks an index, you want the ETF to have minimal tracking error. For example, if the index gains 10%, the ETF should likewise grow by a similar amount. The difference between the return of the index and the ETF is called tracking error, and a good fund manager should be able to reduce tracking error to a minimum.

At this point, the Phillip SING Income ETF has no tracking error data since it hasn’t launched. However, as a yardstick, the tracking error for the Lion-Phillip S-REIT ETF is currently at around 1% according to Phillip Capital Management senior fund manager Tan Teck Leng.

In comparison, the tracking error of SPDR® Straits Times Index ETF is much lower at 0.0524% (as at 31 August 2018). But we have to note that the constituents of the STI are more liquid, which helps to reduce tracking error.

5. Expense ratio

Another important consideration when investing in an ETF is its expense ratio. In addition to management fees, the fund also has other costs like taxes, legal expenses, and accounting and auditing fees. The lower the expense ratio, the better.

The management fee for the Phillip SING Income ETF is currently 0.40% per annum (with a maximum cap of 0.70%). This is comparable to the SPDR® Straits Times Index ETF which has an expense ratio of 0.30% per annum. However, I would keep a watch out if the expense ratio rises beyond 0.50%.

The fifth perspective

If you’re a passive investor who’s looking for yield and exposure only to Singapore-listed stocks, then the Phillip SING Income ETF is definitely an option for you. It gives you immediate diversification in 30 different stocks and pays a reasonable overall dividend of 5.0% (before fees).

However, if you prefer to construct your own portfolio of dividend stocks and REITs, then doing so might be in your interest since you’ll save on annual fees and most likely receive a higher overall dividend through a less-diversified, more concentrated income portfolio.

i thought 17% tax is on all dividends and not just s-reits?

Hi momo,

Dividends are mostly tax-free in Singapore. However, dividends from REITs were previously subject to tax for the ETFs that held them. This was revised in the 2018 Budget.

https://www.iras.gov.sg/IRASHome/Individuals/Locals/Working-Out-Your-Taxes/What-is-Taxable-What-is-Not/Dividends/

Hi,

Re PSIng income ETF

What is the difference in subscribing or purchase in the

Open market?

Thanks

Hi Lee,

During the initial offer period, the subscription price is $1.00 per unit. When the ETF lists, its unit price will then depend on the open market.

Does the STI ETF have tax transparency status?

Hi David,

Tax transparency here only applies to REITs. Let me explain:

An S-REIT is not taxed if it pays at least 90% of its income to unitholders as distributions. In Singapore, you don’t have to pay any personal tax when you receive this distribution.

However, if an ETF receives this distribution — unless it has tax transparency status — it is taxed the prevailing corporate tax rate of 17%, which means you indirectly get taxed.

Regular stocks (businesses) already pay the corporate tax rate of 17% on their profit. So your dividends are already indirectly taxed at the corporate level, and you don’t have to pay any additional personal tax when you receive the dividends.

Hope this helps!

A quick update: I made a check and received a reply from Phillip Capital that the tax transparency treatment only applies to the ETFs that invest entirely in REITs. Therefore, the Phillip SING Income ETF (and the STI ETF) don’t enjoy any tax transparency for their REIT distributions.

I’ve updated the changes in the article 🙂

I am Malaysian if I were to invest into S-REIT, do I need to pay any tax ?

Hi Vincent,

There is no capital gains or dividend withholding tax for Malaysians investing in Singapore REITs.

I have a question on dividend tax. I am a Singapore Citizen and to invest in dividend paying stocks.

Can you please explain which dividends taxed amoungst the following types of publicly traded investments?

S-REIT

S-REIT ETF

Non-S-REIT only ETF

Non-S-REIT company (Singapore resident company such as DBS)

Thank you,

Leslie

Hi Leslie,

The dividends you receive as an investor for the instruments you listed are all tax-exempted.